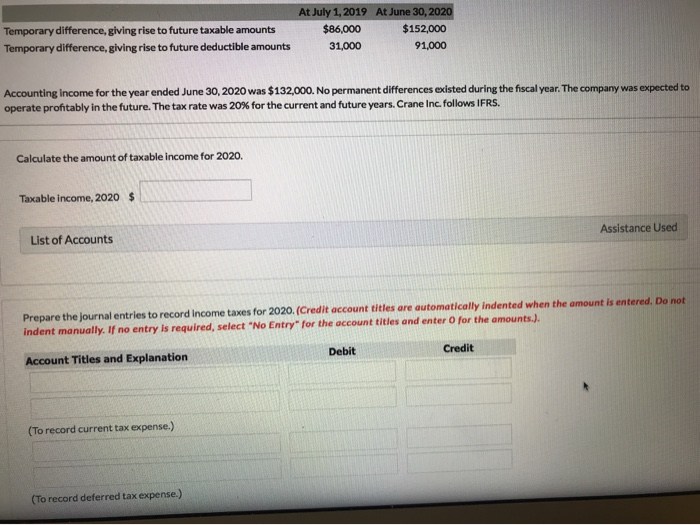

Question: Temporary difference, giving rise to future taxable amounts Temporary difference, giving rise to future deductible amounts At July 1, 2019 At June 30, 2020 $86,000

Temporary difference, giving rise to future taxable amounts Temporary difference, giving rise to future deductible amounts At July 1, 2019 At June 30, 2020 $86,000 $152,000 31,000 91,000 Accounting income for the year ended June 30, 2020 was $132,000. No permanent differences existed during the fiscal year. The company was expected to operate profitably in the future. The tax rate was 20% for the current and future years. Crane Inc. follows IFRS. Calculate the amount of taxable income for 2020. Taxable income, 2020 $ Assistance Used List of Accounts Prepare the journal entries to record income taxes for 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.). Debit Credit Account Titles and Explanation (To record current tax expense.) (To record deferred tax expense.) Calculate the effective rate for 2020. Effective rate, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts