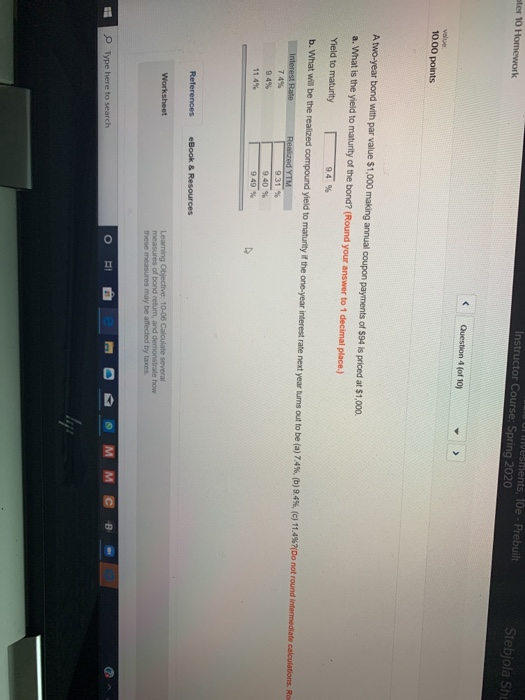

Question: ter 10 Homework vesments, 10e - Prebuilt Instructor Course: Spring 2020 Stebjola Shu Question 4 (of 10) value 10.00 points A two-year bond with par

ter 10 Homework vesments, 10e - Prebuilt Instructor Course: Spring 2020 Stebjola Shu Question 4 (of 10) value 10.00 points A two-year bond with par value $1.000 making annual coupon payments of $94 is priced at $1,000 a. What is the yield to maturity of the bond? (Round your answer to 1 decimal place.) Yield to maturity 94% b. What will be the realized compound yield to maturity if the one-year interest rate next year turns out to be (a) 7.4%, (D) 9.4%, (C) 11. 47Do not round intermediate calculations. Ro Interest Rate 7.4% Realed YTM 9.31 % 9.40 % 94% 11 49% References eBook & Resources Worksheet Learning Objective: 10-00 Calculate several measures of bond retum, and demonstrate how these measures may be affected by taxes Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts