Question: ter 3 k mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate comple

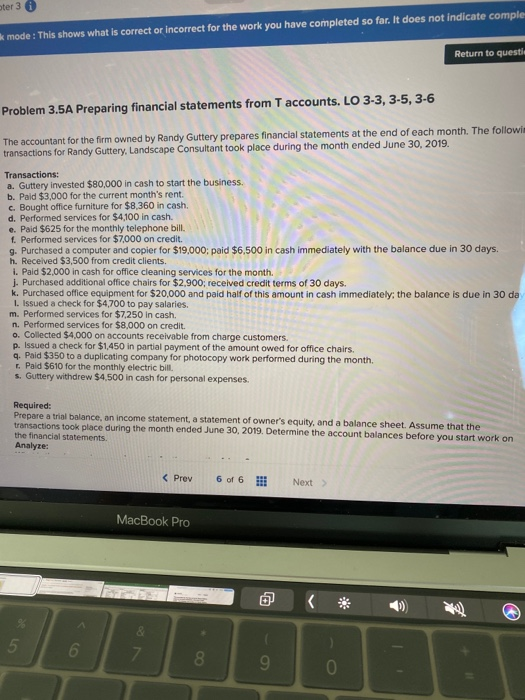

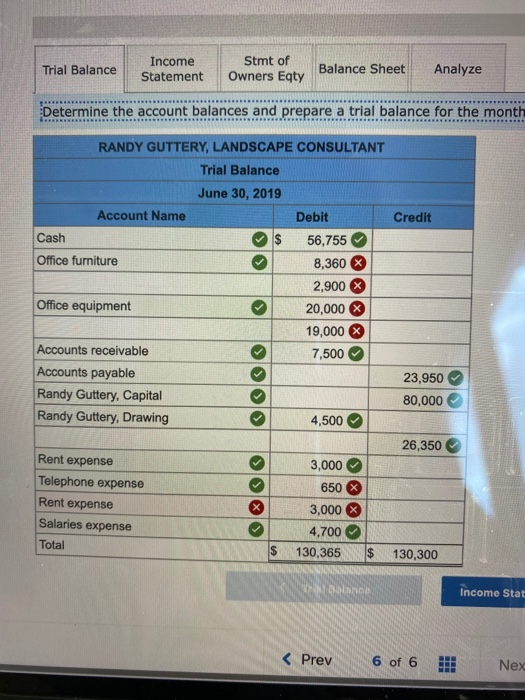

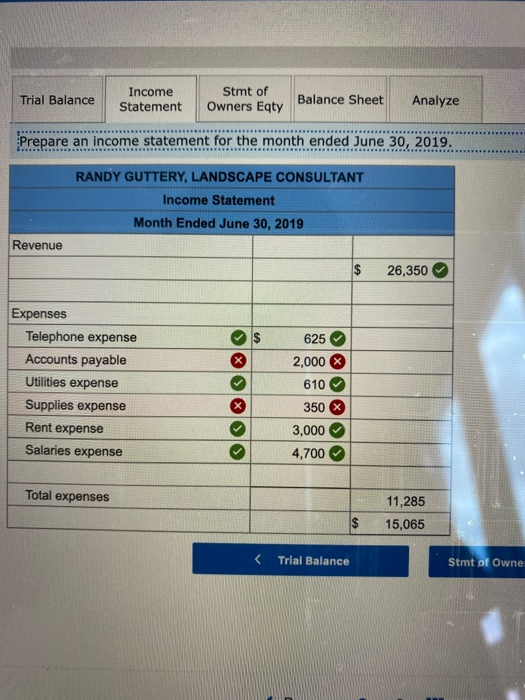

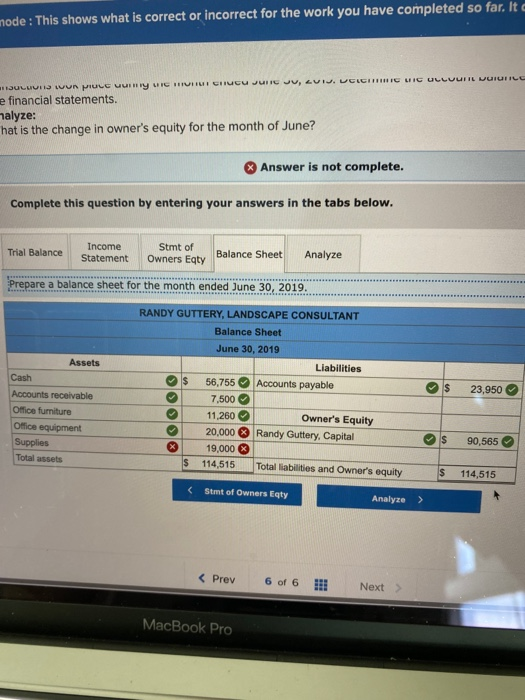

ter 3 k mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate comple Return to questi Problem 3.5A Preparing financial statements from T accounts. LO 3-3, 3-5, 3-6 The accountant for the firm owned by Randy Guttery prepares financial statements at the end of each month. The followin transactions for Randy Guttery, Landscape Consultant took place during the month ended June 30, 2019. Transactions: a. Guttery invested $80,000 in cash to start the business. b. Paid $3,000 for the current month's rent. c. Bought office furniture for $8,360 in cash. d. Performed services for $4,100 in cash. e. Paid $625 for the monthly telephone bill. f. Performed services for $7,000 on credit. 9. Purchased a computer and copier for $19,000; paid $6,500 in cash immediately with the balance due in 30 days. h. Received $3,500 from credit clients. i. Pald $2,000 in cash for office cleaning services for the month 1. Purchased additional office chairs for $2.900; received credit terms of 30 days. k. Purchased office equipment for $20.000 and paid half of this amount in cash immediately, the balance is due in 30 da I. Issued a check for $4,700 to pay salaries. m. Performed services for $7.250 in cash. n. Performed services for $8,000 on credit. o. Collected $4,000 on accounts receivable from charge customers. p. Issued a check for $1,450 in partial payment of the amount owed for office chairs. 4. Paid $350 to a duplicating company for photocopy work performed during the month. . Pald $610 for the monthly electric bill 5. Guttery withdrew $4,500 in cash for personal expenses. Required: Prepare a trial balance, an income statement, a statement of owner's equity, and a balance sheet. Assume that the transactions took place during the month ended June 30, 2019. Determine the account balances before you start work on the financial statements Analyze: MacBook Pro 5 6 7 8 9 0 Trial Balance Income Statement Stmt of Owners Eqty Balance Sheet Analyze Determine the account balances and prepare a trial balance for the month RANDY GUTTERY, LANDSCAPE CONSULTANT Trial Balance June 30, 2019 Account Name Debit Credit Cash $ 56,755 Office furniture 8,360 X 2,900 Office equipment 20,000 19,000 X Accounts receivable 7,500 Accounts payable 23,950 Randy Guttery, Capital 80,000 Randy Guttery, Drawing 4,500 26,350 3,000 Telephone expense 650 3,000 4,700 Total $ 130,365 $ 130,300 OO Rent expense Rent expense Salaries expense Sa UNDLAND Income Stat Expenses Telephone expense Accounts payable Utilities expense Supplies expense Rent expense Salaries expense 625 2,000 610 >>> 350 3,000 4,700 Total expenses 11,285 15,065 $ Trial Balance Stmt of Owne mode : This shows what is correct or incorrect for the work you have completed so far. It . JL LIVI 15 16 Put My | 9 | | | | | | | | | | | | | | | WEIC | | | 444 |t tt ti Lai 1L e financial statements. malyze: hat is the change in owner's equity for the month of June? Answer is not complete. Complete this question by entering your answers in the tabs below. Trial Balance Income Statement Stmt of Owners Eqty Balance Sheet Analyze Prepare a balance sheet for the month ended June 30, 2019. RANDY GUTTERY, LANDSCAPE CONSULTANT Balance Sheet June 30, 2019 Liabilities $ 56,755 Accounts payable 7,500 11,260 Owner's Equity 20,000 Randy Guttery, Capital 19,000 S 114,515 Total liabilities and Owner's equity $ Assets Cash Accounts receivable Office furniture Office equipment Supplies Total assets 23,950 $ 90,565 $ 114,515

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts