Question: TERE! ne the effects for adiusting entries d and e. ince More Info - abiliti a. Office supplies on hand, $100. b. Accrued revenues, $5,000.

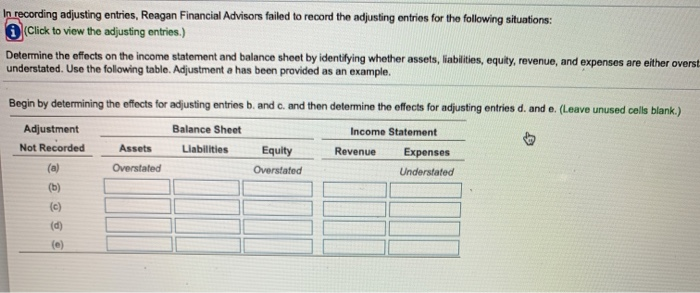

TERE! ne the effects for adiusting entries d and e. ince More Info - abiliti a. Office supplies on hand, $100. b. Accrued revenues, $5,000. c. Accrued interest expense, $250. d. Depreciation, $800. e. Unearned revenue that has been earned, $550. Print Done In recording adjusting entries, Reagan Financial Advisors failed to record the adjusting entries for the following situations: Click to view the adjusting entries.) Determine the effects on the income statement and balance sheet by identifying whether assets, liabilities, equity, revenue, and expenses are either overst understated. Use the following table. Adjustment a has been provided as an example. Begin by determining the effects for adjusting entries b. and c. and then determine the effects for adjusting entries d. and e. (Leave unused cells blank.) Adjustment Balance Sheet Income Statement Not Recorded Assets Liabilities Equity Revenue Expenses Overstated Overstated Understated (b) (c) (d) (e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts