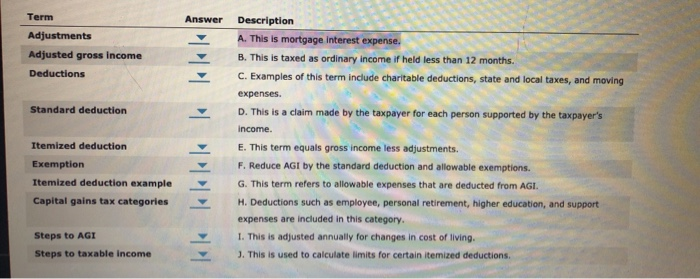

Question: Term Answer Description Adjustments A. This is mortgage interest expense. Adjusted gross income B. This is taxed as ordinary income if held less than 12

Term Answer Description Adjustments A. This is mortgage interest expense. Adjusted gross income B. This is taxed as ordinary income if held less than 12 months. C. Examples of this term include charitable deductions,, state and local taxes, and moving Deductions expenses. D. This is a claim made by the taxpayer for each person supported by the taxpayer's Standard deduction income. Itemized deduction E. This term equals gross income less adjustments. Exemption F. Reduce AGI by the standard deduction and allowable exemptions. Itemized deduction example G. This term refers to allowable expenses that are deducted from AGI H. Deductions such as employee, personal retirement, higher education, and support Capital gains tax categories expenses are included in this category. Steps to AGI I. This is adjusted annually for changes in cost of living. J. This is used to calculate limits for certain itemized deductions. Steps to taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts