Question: Term Answer Description Compound interest A. This is the process of ensuring that the money that left the bank account matches the amount the account

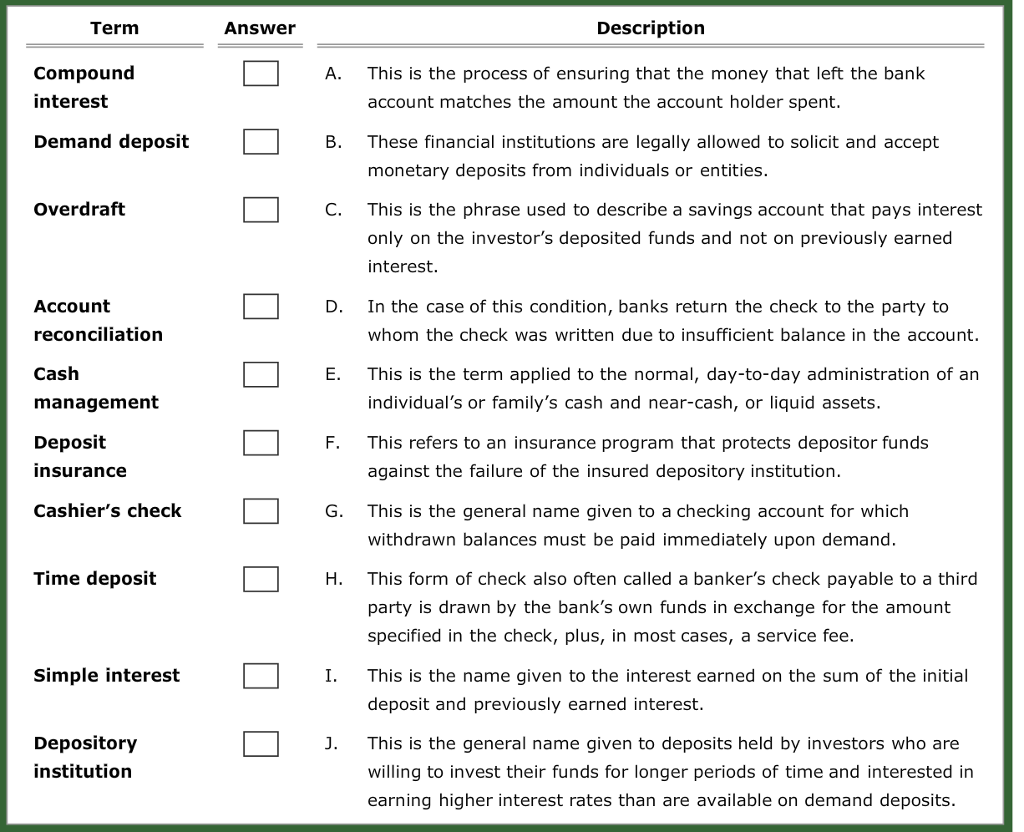

Term Answer Description Compound interest A. This is the process of ensuring that the money that left the bank account matches the amount the account holder spent. Demand deposit B. These financial institutions are legally allowed to solicit and accept monetary deposits from individuals or entities. Overdraft C. This is the phrase used to describe a savings account that pays interest only on the investor's deposited funds and not on previously earned interest. Account reconciliation Cash management Deposit insurance D. In the case of this condition, banks return the check to the party to whom the check was written due to insufficient balance in the account. E. This is the term applied to the normal, day-to-day administration of an individual's or family's cash and near-cash, or liquid assets. F. This refers to an insurance program that protects depositor funds against the failure of the insured depository institution. Cashier's check G. This is the general name given to a checking account for which withdrawn balances must be paid immediately upon demand This form of check also often called a banker's check payable to a third party is drawn by the bank's own funds in exchange for the amount specified in the check, plus, in most cases, a service fee. Time deposit H. Simple interest I. This is the name given to the interest earned on the sum of the initial deposit and previously earned interest Depository institution J. This is the general name given to deposits held by investors who are willing to invest their funds for longer periods of time and interested in earning higher interest rates than are available on demand deposits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts