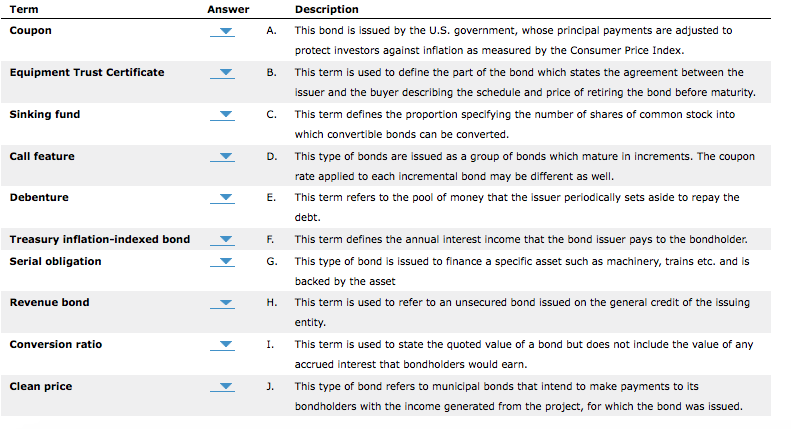

Question: Term Answer Description Coupon A. This bond is issued by the U.S. government, whose principal payments are adjusted to protect investors against infation as measured

Term Answer Description Coupon A. This bond is issued by the U.S. government, whose principal payments are adjusted to protect investors against infation as measured by the Consumer Price Index. This term is used to define the part of the bond which states the agreement between the issuer and the buyer describing the schedule and price of retiring the bond before maturity. This term defines the proportion specifying the number of shares of common stock into which convertible bonds can be converted. This type of bonds are issued as a group of bonds which mature in increments. The coupon rate applied to each incremental bond may be different as well. This term refers to the pool of money that the issuer periodically sets aside to repay the debt. This term defines the annual interest income that the bond issuer pays to the bondholder This type of bond is issued to finance a specific asset such as machinery, trains etc. and is backed by the asset This term is used to refer to an unsecured bond issued on the general credit of the issuing entity Equipment Trust Certificate B. Sinking fund C. Call feature D. Debenture E. Treasury inflation-indexed bond F. Serial obligation G. Revenue bond H. Conversion ratio I.This term is used to state the quoted value of a bond but does not include the value of any accrued interest that bondholders would earn. Clean price J This type of bond refers to municipal bonds that intend to make payments to its bondholders with the income generated from the project, for which the bond was issued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts