Question: Term Answer Description Executor A. This is the person who makes a will. Gross estate This is the personal representative of the decedent, who administers

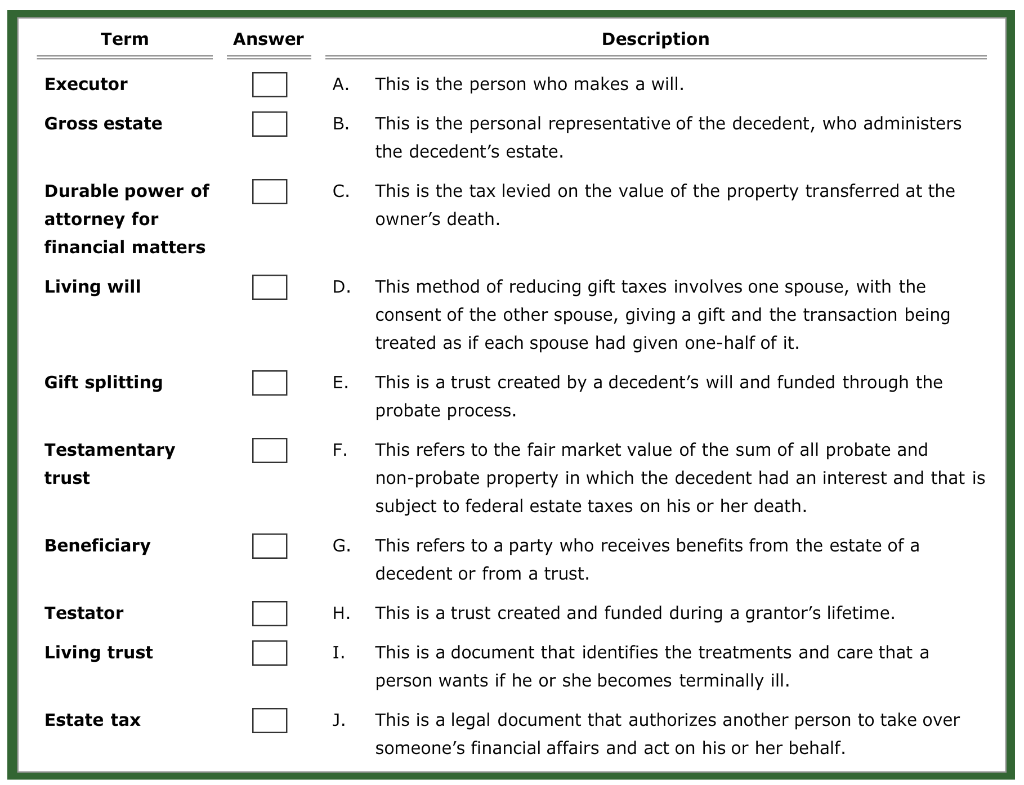

Term Answer Description Executor A. This is the person who makes a will. Gross estate This is the personal representative of the decedent, who administers the decedent's estate. 0 Durable power of attorney for financial matters This is the tax levied on the value of the property transferred at the owner's death. Living will 0 D D. This method of reducing gift taxes involves one spouse, with the consent of the other spouse, giving a gift and the transaction being treated as if each spouse had given one-half of it. Gift splitting E. 0 0 This is a trust created by a decedent's will and funded through the This is a probate process. F. Testamentary trust This refers to the fair market value of the sum of all probate and non-probate property in which the decedent had an interest and that is subject to federal estate taxes on his or her death. Beneficiary This refers to a party who receives benefits from the estate of a decedent or from a trust. 0 OD Testator H. This is a trust created and funded during a grantor's lifetime. Living trust I. This is a document that identifies the treatments and care that a person wants if he or she becomes terminally ill. Estate tax This is a legal document that authorizes another person to take over someone's financial affairs and act on his or her behalf. Term Answer Description Executor A. This is the person who makes a will. Gross estate This is the personal representative of the decedent, who administers the decedent's estate. 0 Durable power of attorney for financial matters This is the tax levied on the value of the property transferred at the owner's death. Living will 0 D D. This method of reducing gift taxes involves one spouse, with the consent of the other spouse, giving a gift and the transaction being treated as if each spouse had given one-half of it. Gift splitting E. 0 0 This is a trust created by a decedent's will and funded through the This is a probate process. F. Testamentary trust This refers to the fair market value of the sum of all probate and non-probate property in which the decedent had an interest and that is subject to federal estate taxes on his or her death. Beneficiary This refers to a party who receives benefits from the estate of a decedent or from a trust. 0 OD Testator H. This is a trust created and funded during a grantor's lifetime. Living trust I. This is a document that identifies the treatments and care that a person wants if he or she becomes terminally ill. Estate tax This is a legal document that authorizes another person to take over someone's financial affairs and act on his or her behalf

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts