Question: Term Answer Description Keogh plan For people in their 30s and 40s, a Roth IRA is an appropriate investment decision A. SEP plan B. An

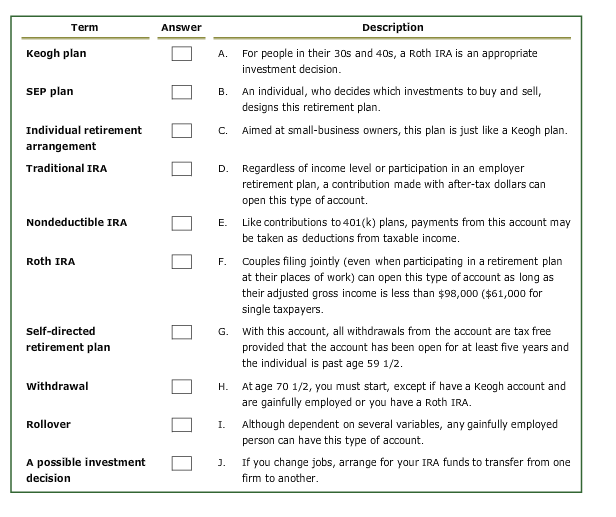

Term Answer Description Keogh plan For people in their 30s and 40s, a Roth IRA is an appropriate investment decision A. SEP plan B. An individual, who decides which investments to buy and sell, designs this retirement plan. Individual retirement C. Aimed at small-business owners, this plan is just like a Keogh plan arrangement Traditional IRAA D. Regardless of income level or participation in an employer retirement plan, a contribution made with after-tax dollars can open this type of account. Nondeductible IRA E.Like contributions to 401(k) plans, payments from this account may be taken as deductions from taxable income Roth IRA Couples filing jointly (even when participating in a retirement plan at their places of work) can open this type of account as long as their adjusted gross income is less than $98,000 ($61,000 for single taxpayers F. G. With this account, all withdrawals from the account are tax free Self-directed retirement plan provided that the account has been open for at least five years and the individual is past age 59 1/2 Withdrawal H. At age 70 1/2, you must start, except if have a Keogh account and are gainfully employed or you have a Roth IRA. Rollover Although dependent on several variables, any gainfully employed person can have this type of account. A possible investment decision If you change jobs, arrange for your IRA funds to transfer from one firm to another

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts