Question: Term Answer Description Risk averse A. This term is used to describe the attitude of an average investor who is likely is avoid higher risk

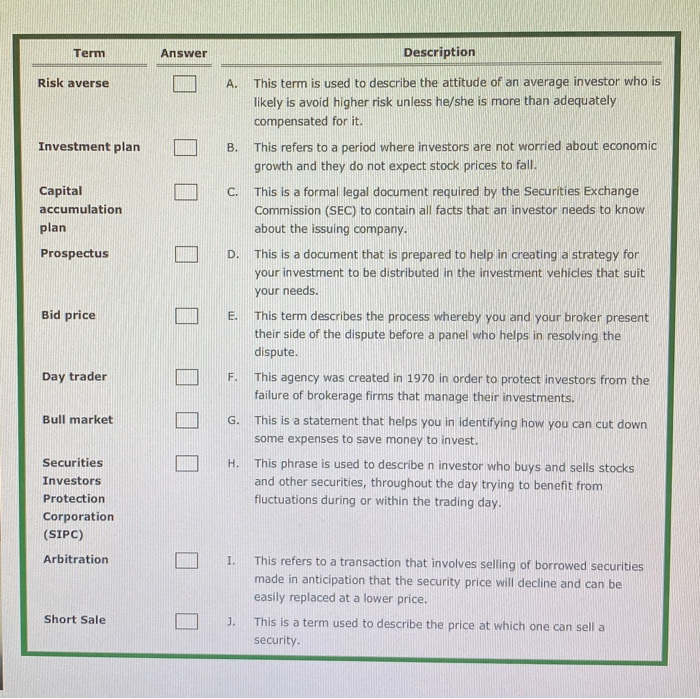

Term Answer Description Risk averse A. This term is used to describe the attitude of an average investor who is likely is avoid higher risk unless he/she is more than adequately compensated for it. Investment plan B. C. Capital accumulation plan This refers to a period where investors are not worried about economic growth and they do not expect stock prices to fall. This is a formal legal document required by the Securities Exchange Commission (SEC) to contain all facts that an investor needs to know about the issuing company. Prospectus D. This is a document that is prepared to help in creating a strategy for your investment to be distributed in the investment vehicles that suit your needs. Bid price This term describes the process whereby you and your broker present their side of the dispute before a panel who helps in resolving the dispute. Day trader Bull market F. This agency was created in 1970 in order to protect investors from the failure of brokerage firms that manage their investments. G. This is a statement that helps you in identifying how you can cut down some expenses to save money to invest. H. This phrase is used to describe n investor who buys and sells stocks and other securities, throughout the day trying to benefit from fluctuations during or within the trading day. Securities Investors Protection Corporation (SIPC) Arbitration This refers to a transaction that involves selling of borrowed securities made in anticipation that the security price will decline and can be easily replaced at a lower price. This is a term used to describe the price at which one can sell a security. Short Sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts