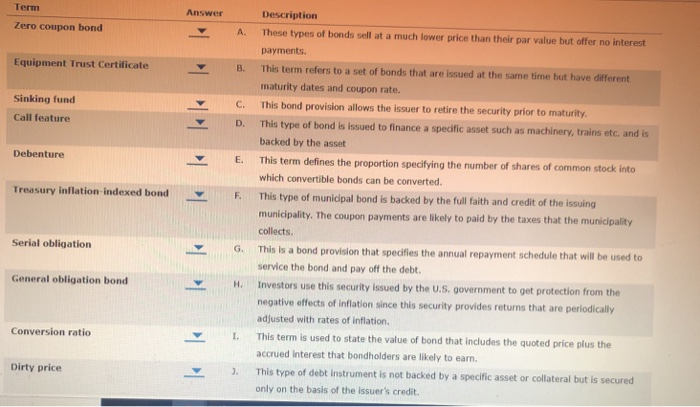

Question: Term Answer Description Zero coupon bond A Equipment Trust Certificate B. Sinking fund Call feature C. D. Debenture E. Treasury inflation-indexed bond F. These types

Term Answer Description Zero coupon bond A Equipment Trust Certificate B. Sinking fund Call feature C. D. Debenture E. Treasury inflation-indexed bond F. These types of bonds sell at a much lower price than their par value but offer no interest payments. This term refers to a set of bonds that are issued at the same time but have different maturity dates and coupon rate. This bond provision allows the issuer to retire the security prior to maturity. This type of bond is issued to finance a specific asset such as machinery, trains etc. and is backed by the asset This term defines the proportion specifying the number of shares of common stock into which convertible bonds can be converted, This type of municipal bond is backed by the full faith and credit of the issuing municipality. The coupon payments are likely to paid by the taxes that the municipality collects. This is a bond provision that specifies the annual repayment schedule that will be used to service the bond and pay off the debt. Investors use this security issued by the U.S. government to get protection from the negative effects of inflation since this security provides returns that are periodically adjusted with rates of inflation. This term is used to state the value of bond that includes the quoted price plus the accrued interest that bondholders are likely to eam. This type of debt instrument is not backed by a specific asset or collateral but is secured only on the basis of the issuer's credit. Serial obligation G. General obligation bond Conversion ratio Dirty price )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts