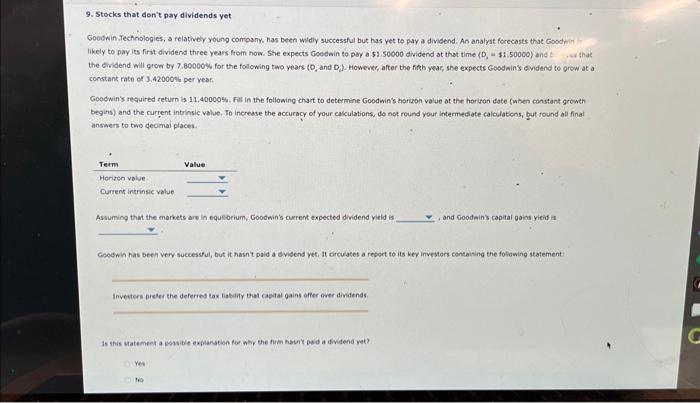

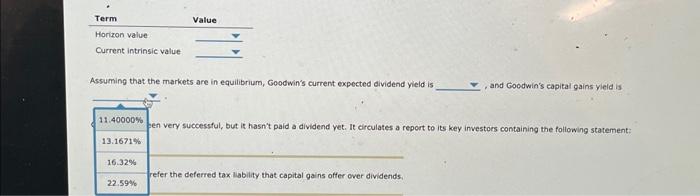

Question: Term Value Horizon value Current intrinsic value Assuming that the markets $15.81 ilibrium, Goodwin's current expected dividend yield is Goodwin has been very suc $27.11,

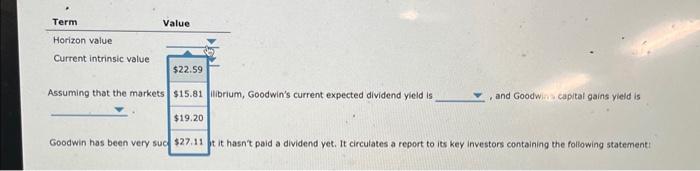

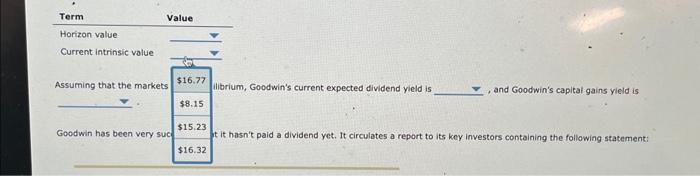

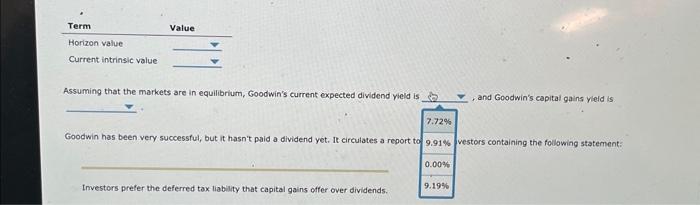

Term Value Horizon value Current intrinsic value Assuming that the markets $15.81 ilibrium, Goodwin's current expected dividend yield is Goodwin has been very suc $27.11, it hasn't paid a dividend vet. It circulates a report to its key investors containing the following statement: \begin{tabular}{ll} Term & Value \\ \hline Horizon value & \\ Current intrinsic value & \end{tabular} Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is , and Goodwin's capital gains yeld is \begin{tabular}{|c|c|} \hline 11.40000% & en very successful, but it hasn't paid a dividend yet. It circulates a rep. \\ \hline 13.1671% & \\ \hline 16.32% & refer the deferred tax liability that capital gains offer over dividends. \\ \hline 22.59% & \end{tabular} 9. Stocks that don't pay dividends yet Googwin. Technologies, a felativery young company, has been widly successful but has yet to pay a dividend. An analyat forecosts that Coodmin constant rate of 3.42000% per vear. Goodwin's reguired return is 11.40000%. Fill in the following chart to determine Goodwin's horizon value at the horitan date fwhen constant growth begins) and the current intrinsic value, To increase the accuracy of your calculations, do not round your intermediate calculatiens, but round all finat answers to two decimal places. Assuming that the markets are in equibrium, Goodwin's current expected dividend yield is , and Coodein's capital gains yieid is Goodwin has been verv successul, but it hasn t paid a dvidend yet. It circulates a report to its ker investers contaiving the following statement Inveuters prefer the deferred tax liabaly that captal gains offer over dividends. Yet the Assuming that the markets are in equilibrium, Goodwin's current expected dividend vield is Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to 9.91% vestors containing the folowing statement: Investors prefer the deferred tax liability that capital gains offer over dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts