Question: Terminal eash flow Replacement decision Russel industries is considering rephoing a fuly depreciated machine that has a renaining useful ife of 10 years with a

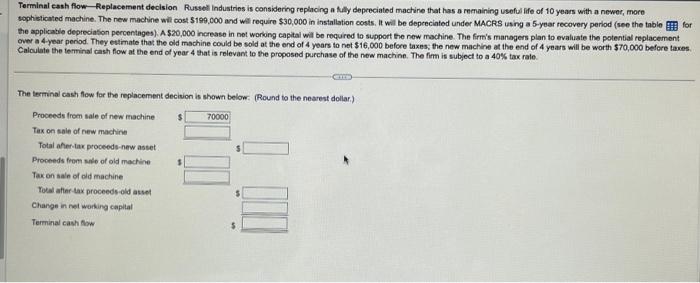

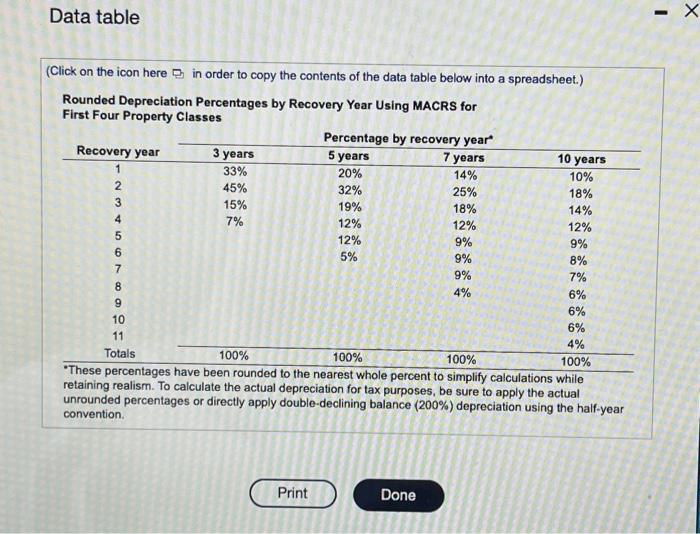

Terminal eash flow Replacement decision Russel industries is considering rephoing a fuly depreciated machine that has a renaining useful ife of 10 years with a newer, more sophisticated machine. The nes machine will cost $199,000 and will require $30,000 in installation costs. It wil be depcecinted under MACRS using a 5-year recovery period (see the table for the applicatle depreciaton percentages). A \$20,000 herease in net wonoing capial wil be required to support the new machine. The firm's managens plan to evaluate the potential replacement over a 4-year period. They ettimate that the old machine could be sold at the end of 4 years to net $16,000 before taxes, the new machine at the end of 4 years will be worth $70,000 before taves. Calculate the teminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 40%5 tax rale. The tertinal cast flow for the replacement decivion is shown below: (Round to the nearest dollar.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes retaine percentages nave been rounded to the nearest whole percent to simplify calculations while unroung realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts