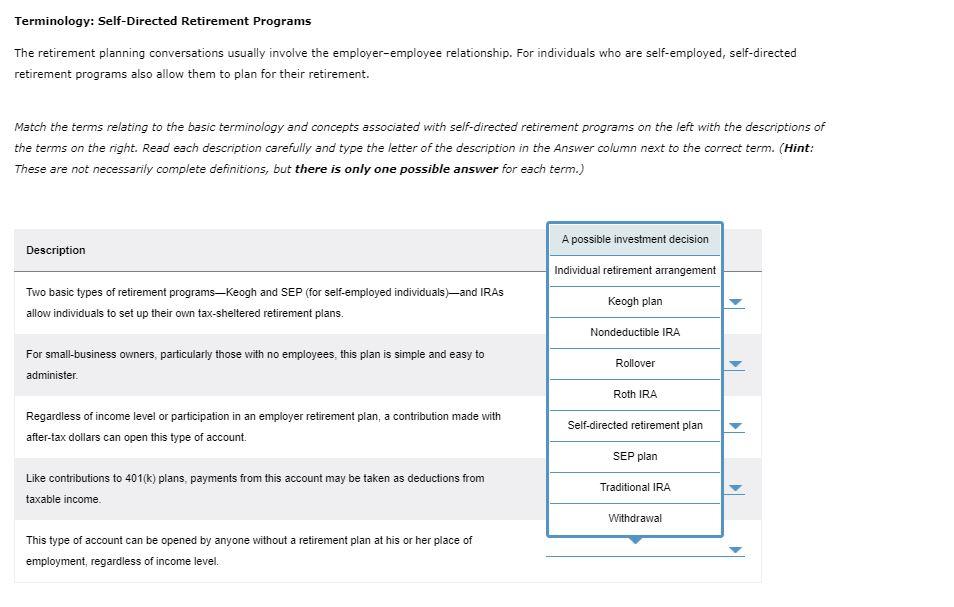

Question: Terminology: Self-Directed Retirement Programs The retirement planning conversations usually involve the employer-employee relationship. For individuals who are self-employed, self-directed retirement programs also allow them to

Terminology: Self-Directed Retirement Programs The retirement planning conversations usually involve the employer-employee relationship. For individuals who are self-employed, self-directed retirement programs also allow them to plan for their retirement Match the terms relating to the basic terminology and concepts associated with self-directed retirement programs on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term. (Hint: These are not necessarily complete definitions, but there is only one possible answer for each term.) A possible investment decision Description Individual retirement arrangement Two basic types of retirement programsKeogh and SEP (for self-employed individuals)and IRAS allow individuals to set up their own tax-sheltered retirement plans. Keogh plan Nondeductible IRA For small-business owners, particularly those with no employees, this plan is simple and easy to administer Rollover Roth IRA Regardless of income level or participation in an employer retirement plan, a contribution made with after-tax dollars can open this type of account. Self-directed retirement plan SEP plan Like contributions to 401(k) plans, payments from this account may be taken as deductions from taxable income Traditional IRA Withdrawal This type of account can be opened by anyone without a retirement plan at his or her place of employment, regardless of income level. Terminology: Self-Directed Retirement Programs The retirement planning conversations usually involve the employer-employee relationship. For individuals who are self-employed, self-directed retirement programs also allow them to plan for their retirement Match the terms relating to the basic terminology and concepts associated with self-directed retirement programs on the left with the descriptions of the terms on the right. Read each description carefully and type the letter of the description in the Answer column next to the correct term. (Hint: These are not necessarily complete definitions, but there is only one possible answer for each term.) A possible investment decision Description Individual retirement arrangement Two basic types of retirement programsKeogh and SEP (for self-employed individuals)and IRAS allow individuals to set up their own tax-sheltered retirement plans. Keogh plan Nondeductible IRA For small-business owners, particularly those with no employees, this plan is simple and easy to administer Rollover Roth IRA Regardless of income level or participation in an employer retirement plan, a contribution made with after-tax dollars can open this type of account. Self-directed retirement plan SEP plan Like contributions to 401(k) plans, payments from this account may be taken as deductions from taxable income Traditional IRA Withdrawal This type of account can be opened by anyone without a retirement plan at his or her place of employment, regardless of income level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts