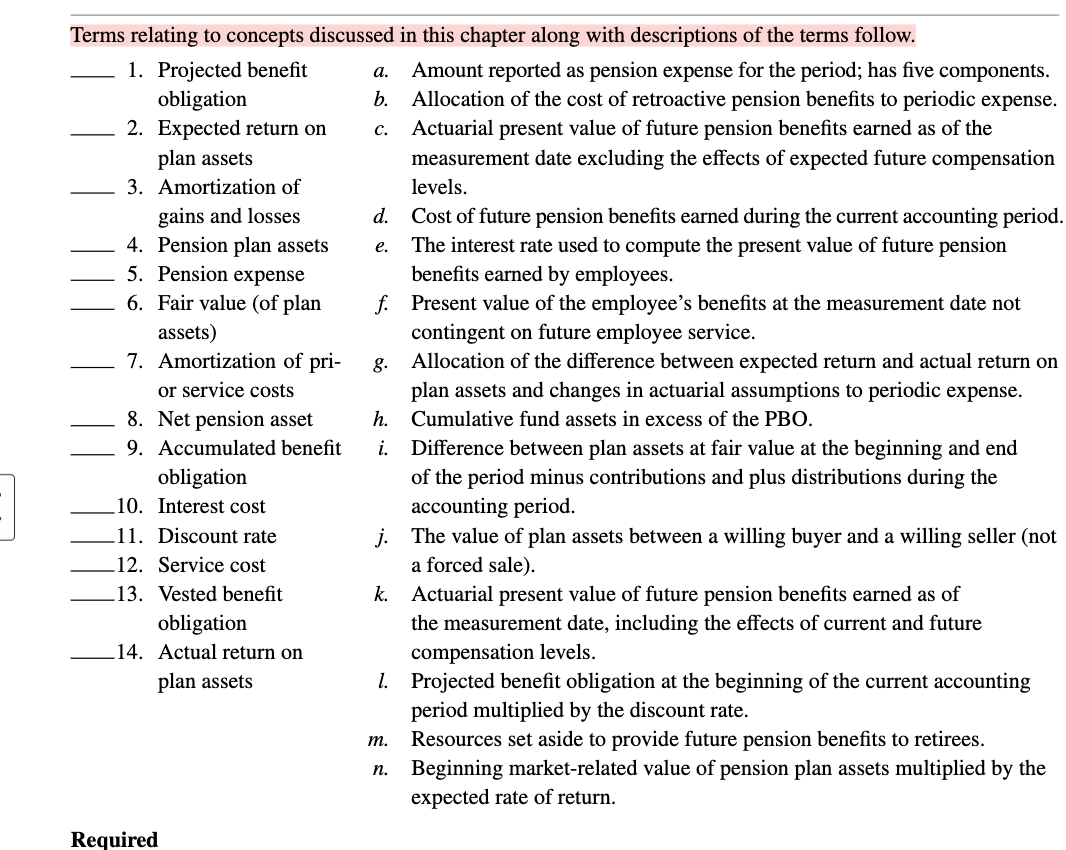

Question: Terms relating to concepts discussed in this chapter along with descriptions of the terms follow. Projected benefit obligation Expected return on plan assets Amortization of

Terms relating to concepts discussed in this chapter along with descriptions of the terms follow.

Projected benefit

obligation

Expected return on

plan assets

Amortization of

gains and losses

Pension plan assets

Pension expense

Fair value of plan

assets

Amortization of pri

or service costs

Net pension asset

Accumulated benefit

obligation

Interest cost

Discount rate

Service cost

Vested benefit

obligation

Actual return on

plan assets

a Amount reported as pension expense for the period; has five components.

b Allocation of the cost of retroactive pension benefits to periodic expense.

c Actuarial present value of future pension benefits earned as of the

measurement date excluding the effects of expected future compensation

levels.

d Cost of future pension benefits earned during the current accounting period.

The interest rate used to compute the present value of future pension

benefits earned by employees.

f Present value of the employee's benefits at the measurement date not

contingent on future employee service.

g Allocation of the difference between expected return and actual return on

plan assets and changes in actuarial assumptions to periodic expense.

h Cumulative fund assets in excess of the PBO.

i Difference between plan assets at fair value at the beginning and end

of the period minus contributions and plus distributions during the

accounting period.

j The value of plan assets between a willing buyer and a willing seller not

a forced sale

k Actuarial present value of future pension benefits earned as of

the measurement date, including the effects of current and future

compensation levels.

l Projected benefit obligation at the beginning of the current accounting

period multiplied by the discount rate.

Resources set aside to provide future pension benefits to retirees.

n Beginning marketrelated value of pension plan assets multiplied by the

expected rate of return.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock