Question: Tesla is considering issuing long term debt. The debt would have a 15 year maturity and a 12 percent coupon rate and make quarterly coupon

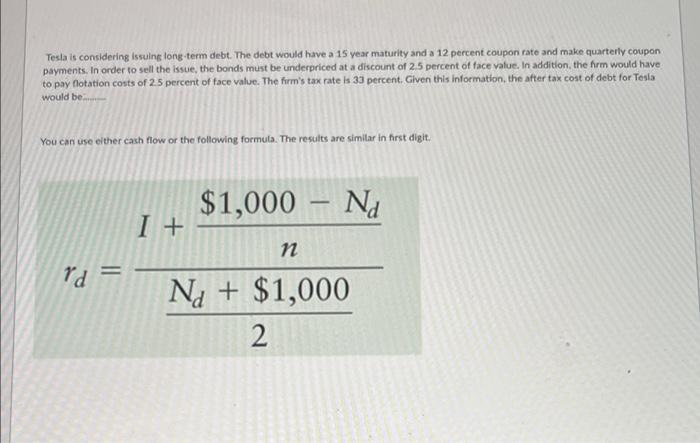

Tesla is considering issuing long term debt. The debt would have a 15 year maturity and a 12 percent coupon rate and make quarterly coupon payments. In order to sell the issue, the bonds must be underpriced at a discount of 2.5 percent of face value. In addition, the firm would have to pay flotation costs of 2.5 percent of tace value. The firm's tax rate is 33 percent. Given this information, the after tax cost of debt for Tesla would be You can use either cash flow or the following formula. The results are similar in first digit. $1,000 Nd I + n 1d Nd + $1,000 2 O 6.3% per annum O 12.7% per annum 0 4.7% per annum O 8.5% per annum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts