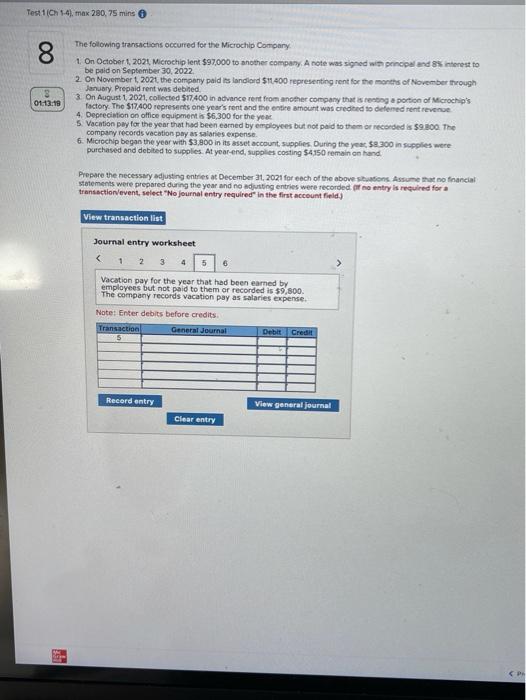

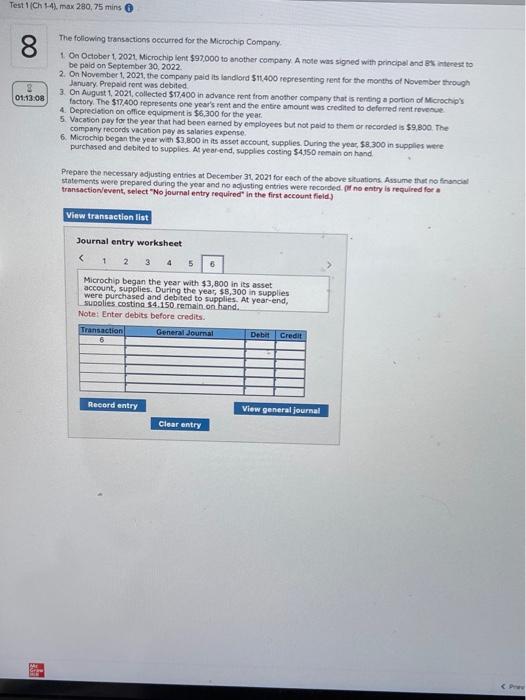

Question: Test 1 (Ch 1-4. max 280,75 mins 8 8 01:13:56 The following transactions occurred for the Microchip Company 1. On October 1, 2021, Microchip lent

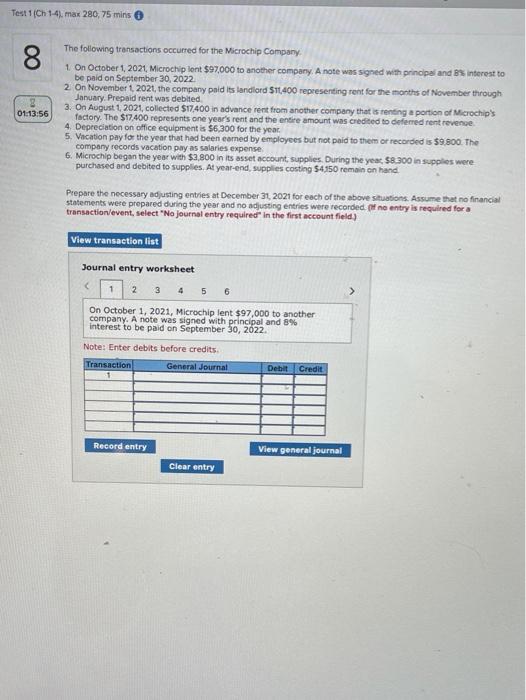

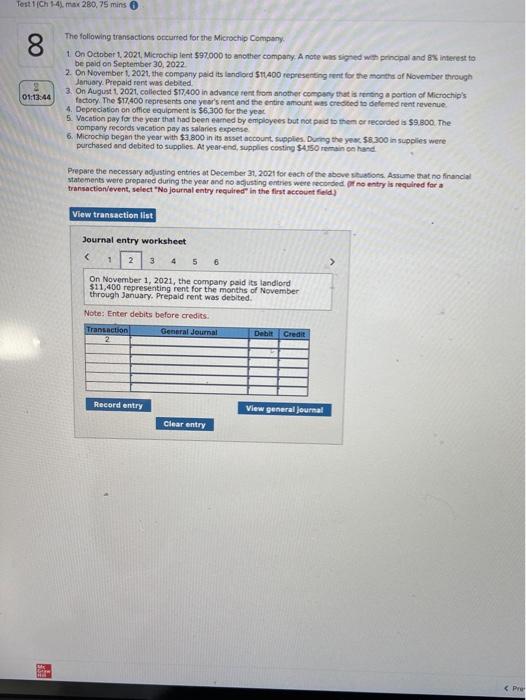

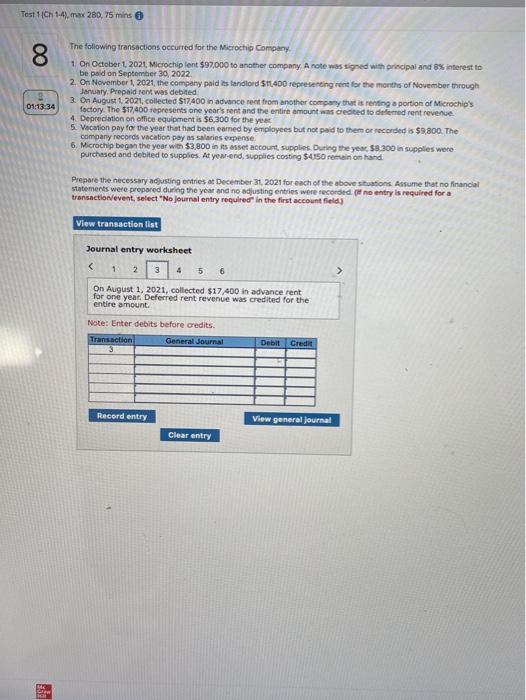

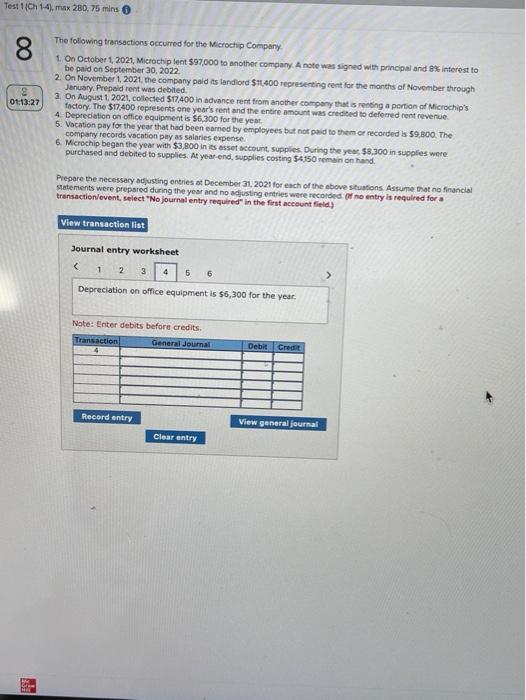

Test 1 (Ch 1-4. max 280,75 mins 8 8 01:13:56 The following transactions occurred for the Microchip Company 1. On October 1, 2021, Microchip lent $97,000 to another company. A note was signed with principal and interest to be paid on September 30, 2022 2 On November 1 2021, the company paid its landlord $11.400 representing rent for the month of November through January. Prepaid rent was debited 3. On August 1, 2021, collected $17.400 in advance rent from another company that is renting a portion of Microchip's factory. The $17.400 represents one year's rent and the entire amount was credited to deferred rent revenge 4 Depreciation on office equipment is 56,300 for the year 5. Vacation pay for the year that had been earned by employees but not paid to them or recorded is $9.800. The company records Vacation pay as salaries expense 6. Microchip began the year with $2,800 in its asset account supplies. During the year. $8.300 in supplies were purchased and debited to supplies. At year-end, supplies costing 54.150 remain on hand Prepare the necessary adjusting entries at December 31, 2021 for each of the above situations. Assume that no financial statements were prepared during the year and no adjusting entries were recorded. (if ne entry is required for a transaction/event, select "No journal entry required in the first account field) View transaction list > Journal entry worksheet 1 2 3 4 5 6 On October 1, 2021, Microchip lent $97,000 to another company. A note was signed with principal and 8% interest to be paid on September 30, 2022 Note: Enter debits before credits Transaction General Journal Debit Credit Record entry View general journal Clear entry Test 1Ch 14. max 280,75 mins 00 The following transactions occurred for the Microchip Company 1 On October 1, 2021, Microchip lent 597,000 to another company. A note was signed with principal and interest to be paid on September 30, 2022 2. On November 1, 2021, the company paid its landlord $11.400 representing tent for the month of November through January. Prepaid rent was debited 3. On August 1, 2021. collected 517400 in advance rent from another company that is renting a portion of Microchip's factory The $17.400 represents one year's rent and the entire amount was credited to defend rent revenue 4. Depreciation on office equipment is $6.300 for the year 5. Vacation pay for the year that had been earned by employees but not paid to them or recorded is $9.800. The company records vacation pay as salaries expense 6. Microchip began the year with $3,800 in its asset account supplies. During the yew $8.300 in supplies were purchased and debited to supplies. At year-end, supplies costing $4150 remain on hand 01:13:44 Prepare the necessary adjusting entries at December 31, 2021 for each of the above stations. Assume that no financial statements s were prepared during the year and no adjusting entries were recorded ne entry is required for a transaction/event, select "No journal entry required in the first account field) View transaction list Journal entry worksheet 1 2 3 4 5 6 > On November 1, 2021, the company paid its landiord $11,400 representing rent for the months of November through January. Prepaid rent was debited Note: Enter debits before credits Transaction General Journal Deble Credit 2 Record entry View general Journal Clear entry Depreciation on office equipment is $6,300 for the year Note: Enter debits before credits Transaction General Journal Debit Credit Record entry View general journal Clear entry Test 1 Ch 1-4), max 280,75 mins 8 3 01:13:19 The following transactions occurred for the Microchip Company 1. On October 1, 2021. Microchip lent $97,000 to another company. A note was signed with principal and interest to be paid on September 30, 2022 2. On November 1, 2021, the company paid its landlord $11.400 representing rent for the months of November through January, Prepaid rent was debited. 3. On August 1, 2021, collected 517400 in advance rent from another company that is reg a portion of Microchip's factory. The $17400 represents one year's rent and the entire amount was created to deferred rent revenue 4 Depreciation on office equipment is $6,300 for the year 5 Vacation pay for the year that had been earned by employees but not paid to them or recorded is $9.000 The company records Vacation payas salaries expense 6. Microchip began the year with $3,800 in its asset account supplies. During the year $2.300 in supplies were purchased and debited to supplies. At year-end, suples costing 54150 remain on hand Prepare the necessary adjusting entries at December 31, 2021 for each of the above situations. Assume that no financial statements were prepared during the year and no adjusting entries were recorded of me entry is required for a transaction event, select "No journal entry required in the first account field) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts