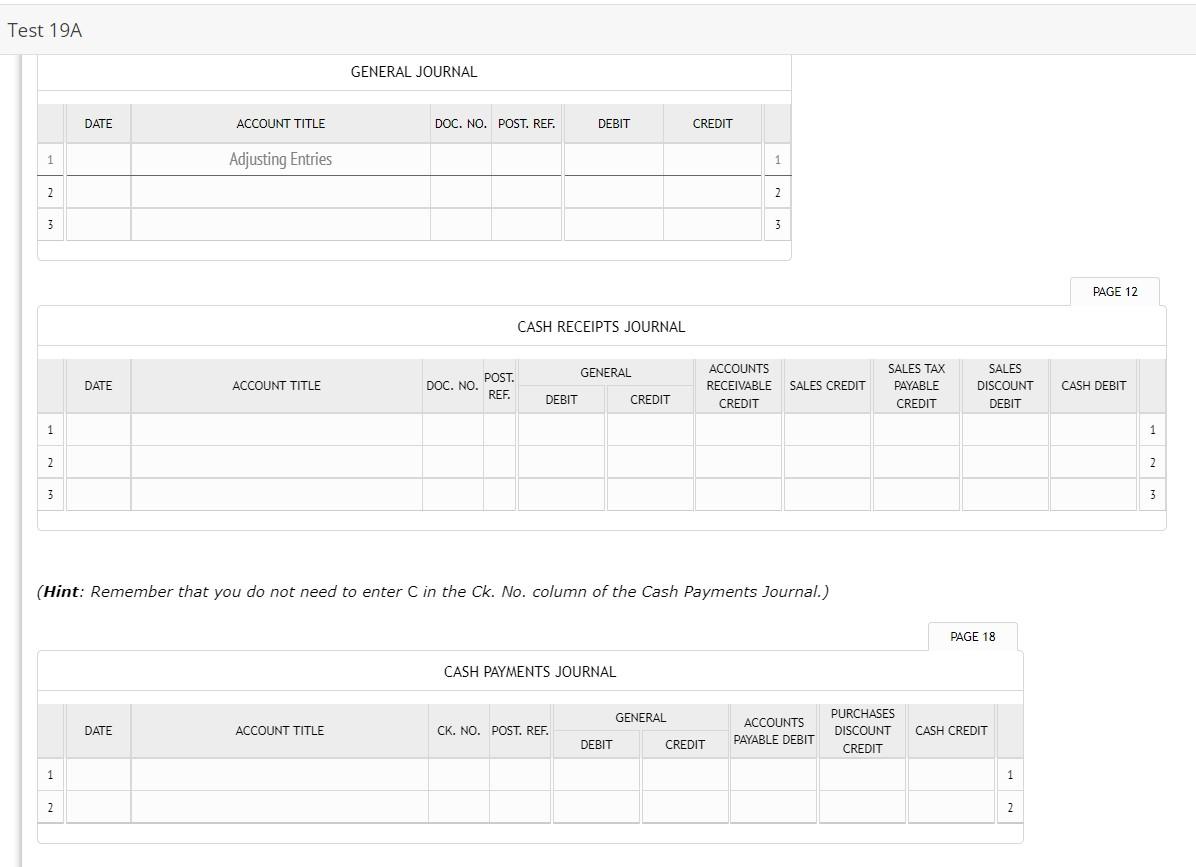

Question: Test 19A GENERAL JOURNAL DATE ACCOUNT TITLE DOC. NO. POST. REF. DEBIT CREDIT 1 Adjusting Entries 1 2 2 3 3 PAGE 12 CASH RECEIPTS

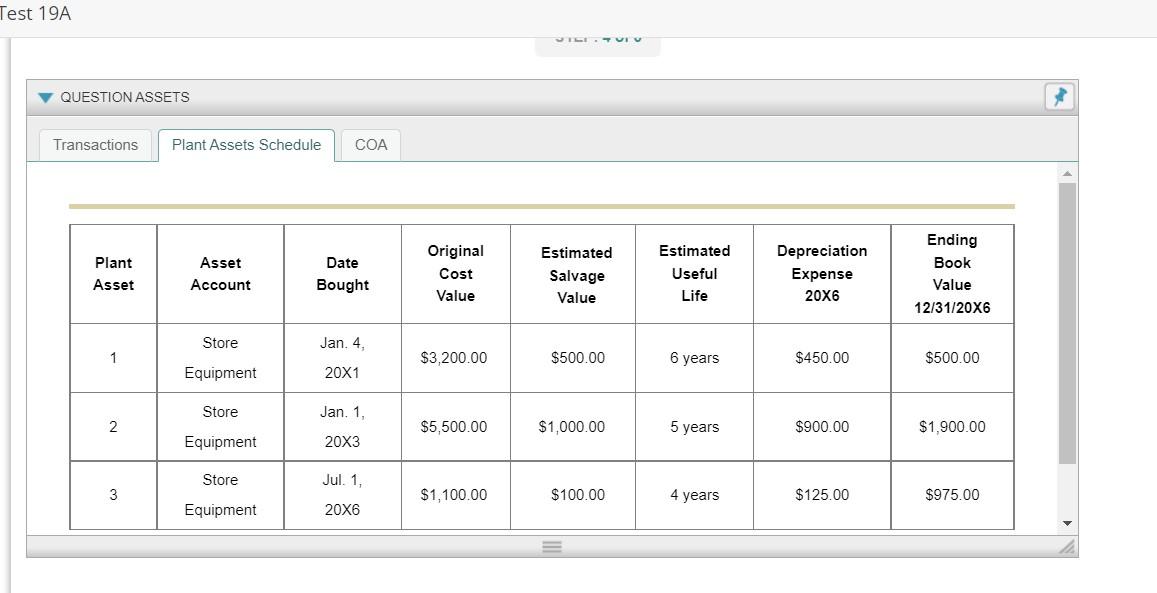

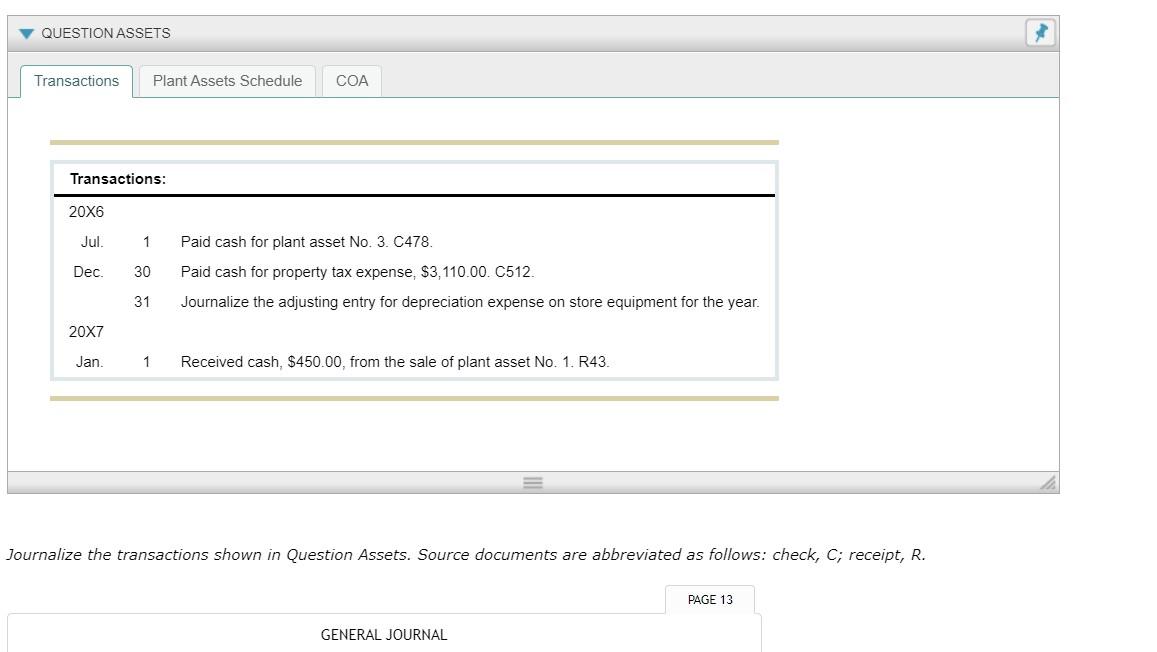

Test 19A GENERAL JOURNAL DATE ACCOUNT TITLE DOC. NO. POST. REF. DEBIT CREDIT 1 Adjusting Entries 1 2 2 3 3 PAGE 12 CASH RECEIPTS JOURNAL GENERAL DATE ACCOUNT TITLE POST. DOC. NO. REF. ACCOUNTS RECEIVABLE SALES CREDIT CREDIT SALES TAX PAYABLE CREDIT SALES DISCOUNT DEBIT CASH DEBIT DEBIT CREDIT 1 1 2 2 3 3 (Hint: Remember that you do not need to enter C in the Ck. No. column of the Cash Payments Journal.) PAGE 18 CASH PAYMENTS JOURNAL GENERAL DATE ACCOUNT TITLE CK. NO. POST. REF. ACCOUNTS PAYABLE DEBIT PURCHASES DISCOUNT CREDIT CASH CREDIT DEBIT CREDIT 1 1 2 2 Test 19A QUESTION ASSETS Transactions Plant Assets Schedule COA Plant Asset Asset Account Date Bought Original Cost Value Estimated Salvage Value Estimated Useful Life Depreciation Expense 20X6 Ending Book Value 12/31/20X6 Store Jan. 4, 1 $3,200.00 $500.00 6 years $450.00 $500.00 Equipment 20X1 Store Jan. 1. 2 $5,500.00 $1,000.00 5 years $900.00 $1,900.00 Equipment 20X3 Store Jul. 1, 3 $1,100.00 $100.00 4 years 4 $125.00 $975.00 Equipment 20X6 QUESTION ASSETS Transactions Plant Assets Schedule COA Transactions: 20X6 Jul. 1 Dec. 30 Paid cash for plant asset No. 3. C478. Paid cash for property tax expense, $3,110.00. C512 Journalize the adjusting entry for depreciation expense on store equipment for the year. 31 20X7 Jan. 1 Received cash, $450.00, from the sale of plant asset No. 1. R43. Journalize the transactions shown in Question Assets. Source documents are abbreviated as follows: check, C; receipt, R. PAGE 13 GENERAL JOURNAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts