Question: TEST 2 DIRECTIONS : Each question or incomplete statement is followed by several suggested answers or completions. Select the one that BEST answers the question

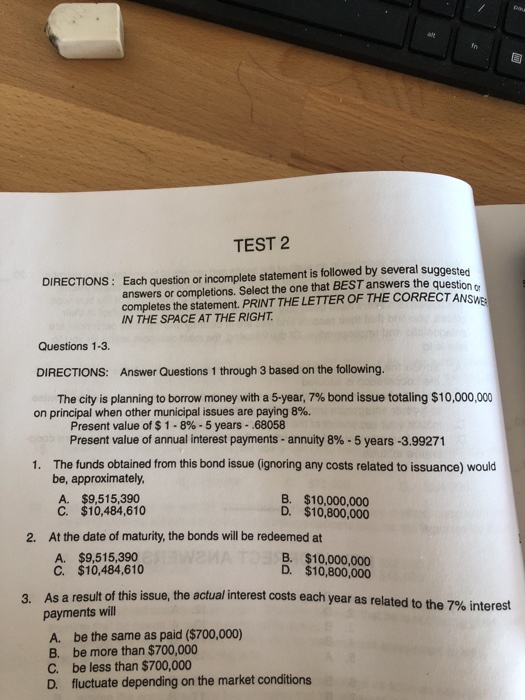

TEST 2 DIRECTIONS : Each question or incomplete statement is followed by several suggested answers or completions. Select the one that BEST answers the question completes the statement. PRINT THE LETTER OF THE CORRECT ANSUN IN THE SPACE AT THE RIGHT. Questions 1-3. DIRECTIONS: Answer Questions 1 through 3 based on the following. The city is planning to borrow money with a 5-year, 7% bond issue totaling $10,000,000 on principal when other municipal issues are paying 8%. Present value of $ 1 - 8% -5 years - .68058 Present value of annual interest payments - annuity 8% -5 years -3.99271 1. The funds obtained from this bond issue (ignoring any costs related to issuance) would be, approximately, A. $9,515,390 B. $10,000,000 C. $10,484,610 D. $10,800,000 2. At the date of maturity, the bonds will be redeemed at A. $9,515,390 B. $10,000,000 C. $10,484,610 D. $10,800,000 As a result of this issue, the actual interest costs each year as related to the 7% interest payments will A. be the same as paid ($700,000) B. be more than $700,000 C. be less than $700,000 D. fluctuate depending on the market conditions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts