Question: TEST 2. Explain the differences between the Profit and Interest. (5Marks) - (C2) TEST 3. Explain the differences between conventional and islamic banking in the

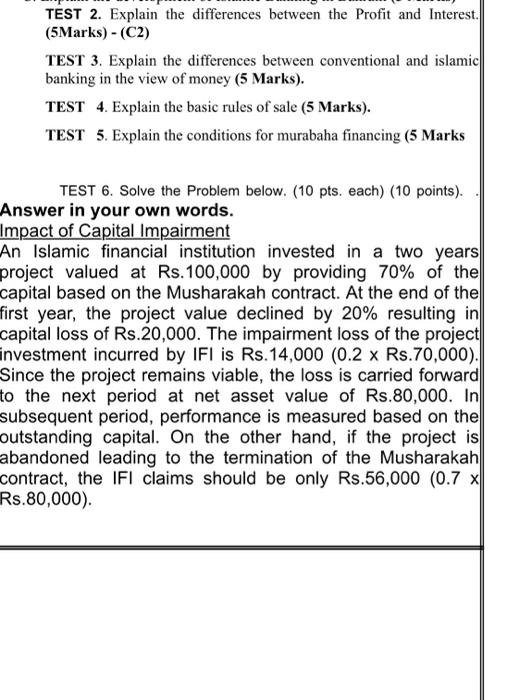

TEST 2. Explain the differences between the Profit and Interest. (5Marks) - (C2) TEST 3. Explain the differences between conventional and islamic banking in the view of money (5 Marks). TEST 4. Explain the basic rules of sale (5 Marks). TEST 5. Explain the conditions for murabaha financing (5 Marks TEST 6. Solve the Problem below. (10 pts, each) (10 points). Answer in your own words. Impact of Capital Impairment An Islamic financial institution invested in a two years project valued at Rs. 100,000 by providing 70% of the capital based on the Musharakah contract. At the end of the first year, the project value declined by 20% resulting in capital loss of Rs.20,000. The impairment loss of the project investment incurred by IFI is Rs. 14,000 (0.2 x Rs.70,000). Since the project remains viable, the loss is carried forward to the next period at net asset value of Rs.80,000. In subsequent period, performance is measured based on the outstanding capital. On the other hand, if the project is abandoned leading to the termination of the Musharakah contract, the IFI claims should be only Rs.56,000 (0.7 x Rs.80,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts