Question: Test 2 Summer 2021 Given. Compatibility Mode - Word Search it References Mailings Review View Help A A A A E211 A2-A AalbCel AaBbce AaBBC

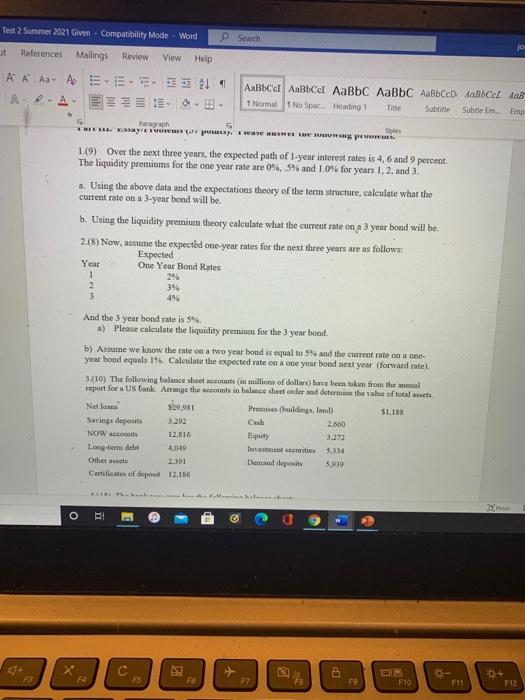

Test 2 Summer 2021 Given. Compatibility Mode - Word Search it References Mailings Review View Help A A A A E211 A2-A AalbCel AaBbce AaBBC AaBbc AaBbCcDAoBocel AaB 1 Normal No Spac. Heading 1 Emp Title Subtitle Subele Em Tagah KOLERUPT Was UW PARTS 19) Over the next three years, the expected path of 1-year interest rates is 4, 6 and 9 percent. The liquidity premiums for the one year rate are 0%, 5% and 10% for years 1, 2 and 3. a. Using the above data and the expectations theory of the term structure, calculate what the current rate on a 3-year bond will be b. Using the liquidity premium theory calculate what the current rate on a 3 yeur bond will be. 2./8) Now, assume the expected one-year rates for the next three years are as follows: Expected One Year Bond Rates Year 1 2 3 3% 4% And the 3 year bond rate is 5%. a) Please calculate the liquidity premium for the 3 year bood b) Assume we know the rate on a two year bond is equal to 5% and the current rate ou a co year bond equals 1% Calculate the expected rate on a one year bond next year (forward rate). 3.(10) The following balance sheet account (in millions of dollars have been taken from the al report for a US Bank Arrange the secounts in balance sheet order and determine the value of totalt Netlon sh0.981 Premises (building, and $1.18 Savings deposits 36292 Cash 2,660 NOW account 12.16 Longform debe 4,049 Equity 3.272 Invice 5.334 Demand deposits 5.939 Odens 2.391 Certies of deposit 12,186 O C ( A FO 75 F6 F7 FO F10 F11 F12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts