Question: TEST - BAFB 3 0 1 3 Financial Management ( CLO 2 ) Name: Matric No: b . Honey Sdn Bhd ( HSB ) anticipates

TEST BAFB Financial Management CLO

Name:

Matric No:

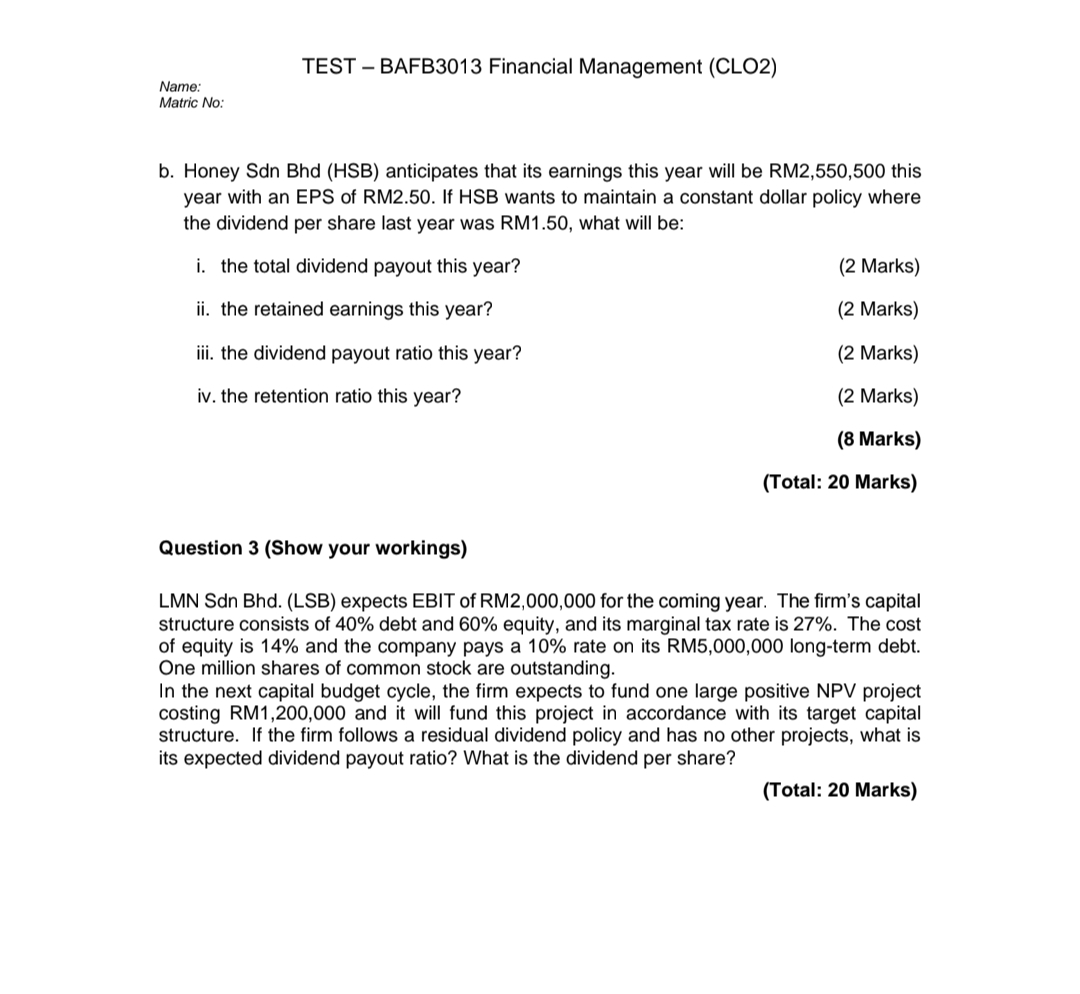

b Honey Sdn Bhd HSB anticipates that its earnings this year will be RM this year with an EPS of RM If HSB wants to maintain a constant dollar policy where the dividend per share last year was RM what will be:

i the total dividend payout this year?

Marks

ii the retained earnings this year?

Marks

iii. the dividend payout ratio this year?

Marks

iv the retention ratio this year?

Marks

Marks

Total: Marks

Question Show your workings

LMN Sdn BhdLSB expects EBIT of RM for the coming year. The firm's capital structure consists of debt and equity, and its marginal tax rate is The cost of equity is and the company pays a rate on its RM longterm debt. One million shares of common stock are outstanding.

In the next capital budget cycle, the firm expects to fund one large positive NPV project costing RM and it will fund this project in accordance with its target capital structure. If the firm follows a residual dividend policy and has no other projects, what is its expected dividend payout ratio? What is the dividend per share?

Total: Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock