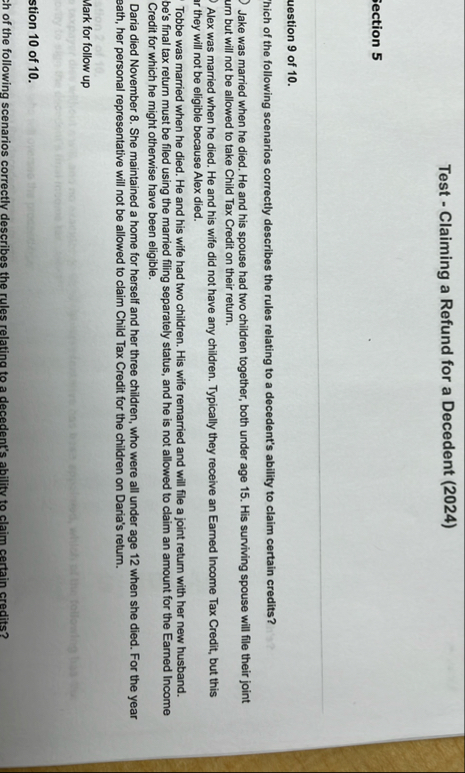

Question: Test - Claiming a Refund for a Decedent ( 2 0 2 4 ) ection 5 uestion 9 of 1 0 . hich of the

Test Claiming a Refund for a Decedent

ection

uestion of

hich of the following scenarios correctly describes the rules relating to a decedent's ability to claim certain credits?

Jake was married when he died. He and his spouse had two children together, both under age His surviving spouse will file their joint urn but will not be allowed to take Child Tax Credit on their return.

Alex was married when he died. He and his wife did not have any children. Typically they receive an Earned Income Tax Credit, but this ar they will not be eligible because Alex died.

Tobbe was married when he died. He and his wife had two children. His wife remarried and will file a joint return with her new husband. be's final tax return must be filed using the married filing separately status, and he is not allowed to claim an amount for the Earned Income Credit for which he might otherwise have been eligible.

Daria died November She maintained a home for herself and her three children, who were all under age when she died. For the year eath, her personal representative will not be allowed to claim Child Tax Credit for the children on Daria's return.

Mark for follow up

stion of

ch of the following scenarios correctly describes the rules relating to a decedent's abilitv to claim certain credits?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock