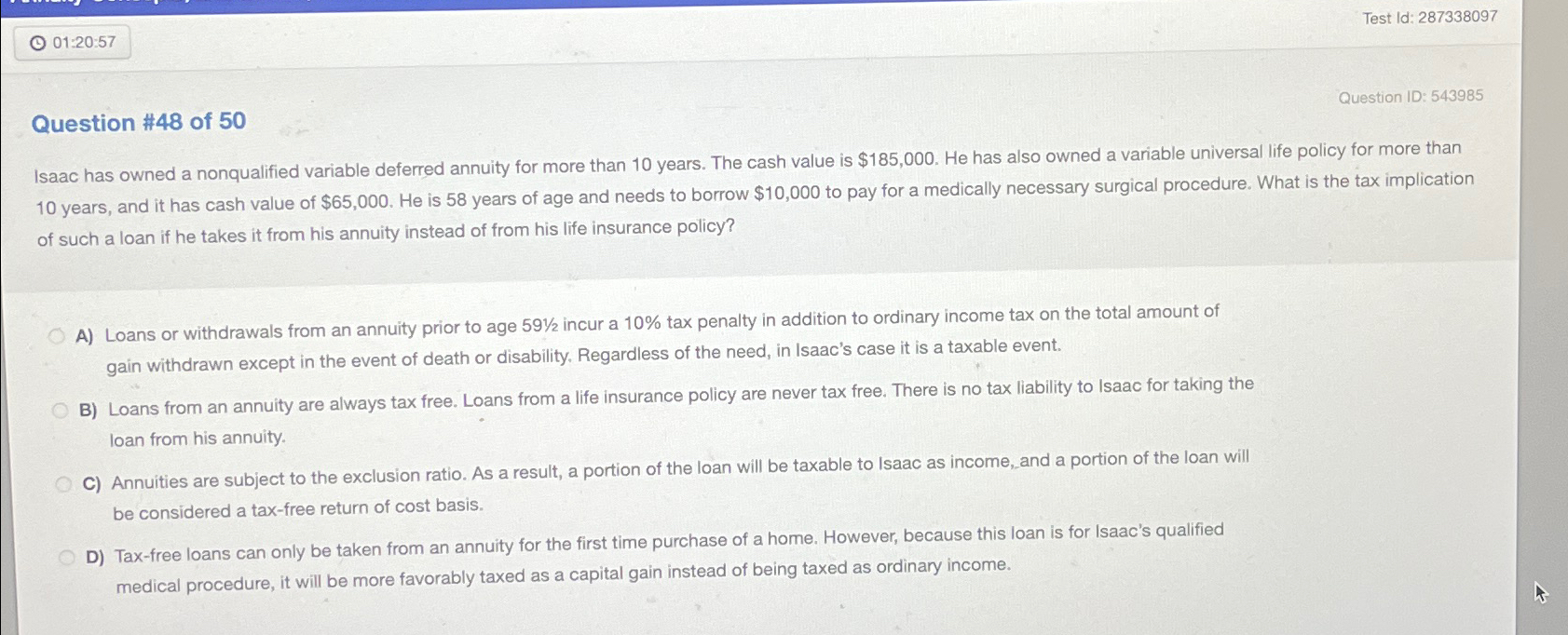

Question: Test Id: 2 8 7 3 3 8 0 9 7 Question # 4 8 of 5 0 Question ID: 5 4 3 9 8

Test Id:

Question # of

Question ID:

Isaac has owned a nonqualified variable deferred annuity for more than years. The cash value is $ He has also owned a variable universal life policy for more than years, and it has cash value of $ He is years of age and needs to borrow $ to pay for a medically necessary surgical procedure. What is the tax implication of such a loan if he takes it from his annuity instead of from his life insurance policy?

A Loans or withdrawals from an annuity prior to age incur a tax penalty in addition to ordinary income tax on the total amount of gain withdrawn except in the event of death or disability. Regardless of the need, in Isaac's case it is a taxable event.

B Loans from an annuity are always tax free. Loans from a life insurance policy are never tax free. There is no tax liability to Isaac for taking the loan from his annuity.

C Annuities are subject to the exclusion ratio. As a result, a portion of the loan will be taxable to Isaac as income, and a portion of the loan will be considered a taxfree return of cost basis.

D Taxfree loans can only be taken from an annuity for the first time purchase of a home. However, because this loan is for Isaac's qualified medical procedure, it will be more favorably taxed as a capital gain instead of being taxed as ordinary income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock