Question: Test Information Description Instructions Timed Test This test has a time limit of 1 hour and 30 minutes. This test will save and submit automatically

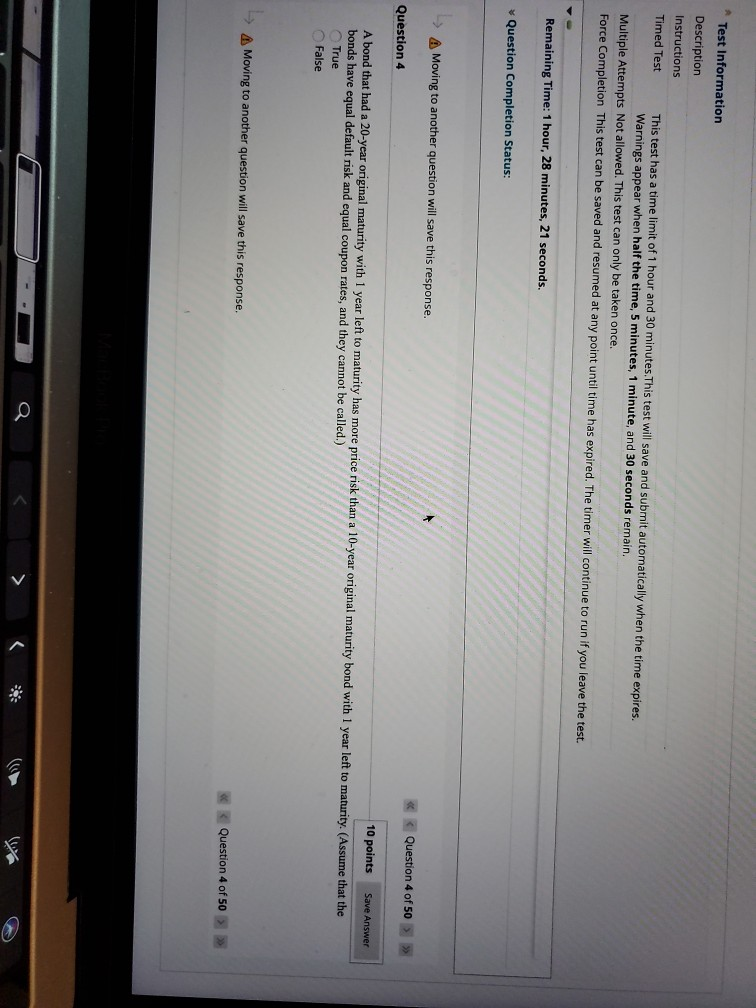

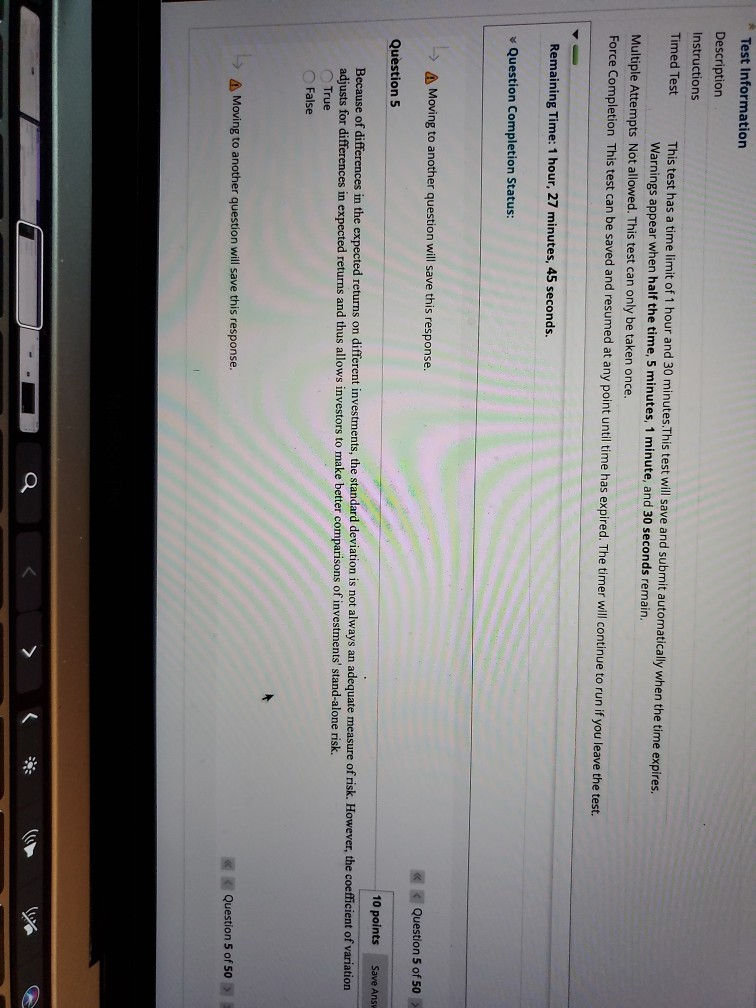

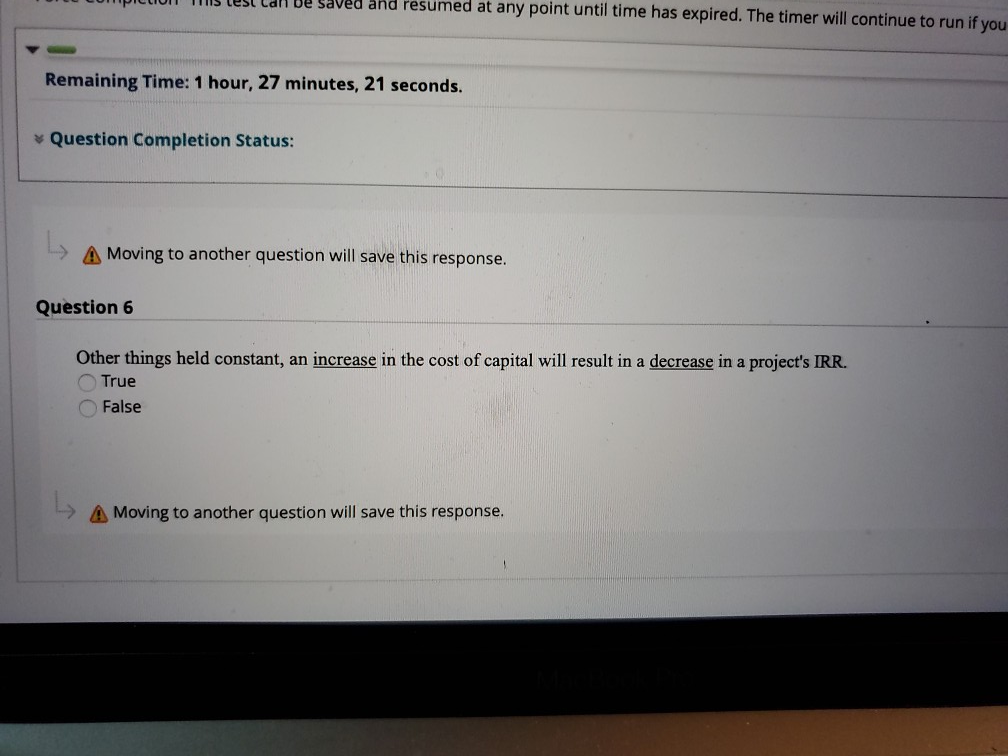

Test Information Description Instructions Timed Test This test has a time limit of 1 hour and 30 minutes. This test will save and submit automatically when the time expires. Warnings appear when half the time, 5 minutes, 1 minute, and 30 seconds remain. Multiple Attempts Not allowed. This test can only be taken once. Force Completion This test can be saved and resumed at any point until time has expired. The timer will continue to run if you leave the test. Remaining Time: 1 hour, 28 minutes, 21 seconds. Question Completion Status: -> A Moving to another question will save this response. Question 4 of 50 > >> Question 4 10 points Save Answer A bond that had a 20-year original maturity with 1 year left to maturity has more price risk than a 10-year original maturity bond with 1 year left to maturity. (Assume that the bonds have equal default risk and equal coupon rates, and they cannot be called.) True False - A Moving to another question will save this response. >> Test Information Description Instructions Timed Test This test has a time limit of 1 hour and 30 minutes. This test will save and submit automatically when the time expires. Warnings appear when half the time, 5 minutes, 1 minute, and 30 seconds remain. Multiple Attempts Not allowed. This test can only be taken once. Force Completion This test can be saved and resumed at any point until time has expired. The timer will continue to run if you leave the test. Remaining Time: 1 hour, 27 minutes, 45 seconds. Question Completion Status: > A Moving to another question will save this response. Question 5 10 points Save Ans Because of differences in the expected returns on different investments, the standard deviation is not always an adequate measure of risk. However, the coefficient of variation adjusts for differences in expected returns and thus allows investors to make better comparisons of investments' stand-alone risk. True False A Moving to another question will save this response. Question 5 of 50 vest van ve saved and resumed at any point until time has expired. The timer will continue to run if you Remaining Time: 1 hour, 27 minutes, 21 seconds. Question Completion Status: A Moving to another question will save this response. Question 6 Other things held constant, an increase in the cost of capital will result in a decrease in a project's IRR. True False > A Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts