Question: Test - Intermediate Rental Real Estate ( 2 0 2 5 ) Special Rental Situations Question 1 5 of 1 5 . Jen rents out

Test Intermediate Rental Real Estate

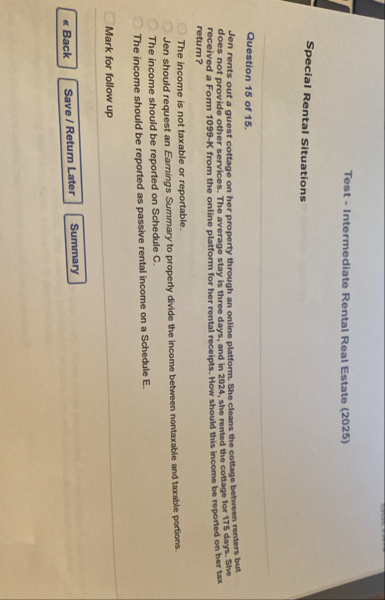

Special Rental Situations

Question of

Jen rents out a guest cottage on her property through an online platform. She cleans the cottage between renters but does not provide other services. The average stay is three days, and in she rented the cottage for days. She received a Form K from the online platform for her rental receipts. How should this income be reported on her tax return?

The income is not taxable or reportable.

Jen should request an Earnings Summary to properly divide the income between nontaxable and taxable portions.

The income should be reported on Schedule C

The income should be reported as passive rental income on a Schedule E

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock