Question: Test - Intermediate Rental Real Estate ( 2 0 2 5 ) Qualified Business Income Deduction Question 1 3 of 1 5 . Which taxpayer

Test Intermediate Rental Real Estate

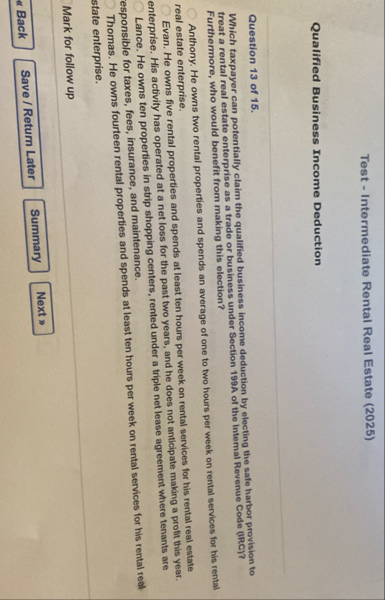

Qualified Business Income Deduction

Question of

Which taxpayer can potentially claim the qualified business income deduction by electing the safe harbor provision to treat a rental real estate enterprise as a trade or business under Section A of the Internal Revenue Code IRC Furthermore, who would benefit from making this election?

Anthony. He owns two rental properties and spends an average of one to two hours per week on rental services for his rental real estate enterprise.

Evan. He owns five rental properties and spends at least ten hours per week on rental services for his rental real estate enterprise. His activity has operated at a net loss for the past two years, and he does not anticipate making a profit this year. Lance. He owns ten properties in strip shopping centers, rented under a triple net lease agreement where tenants are esponsible for taxes, fees, insurance, and maintenance.

Thomas. He owns fourteen rental properties and spends at least ten hours per week on rental services for his rental real state enterprise.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock