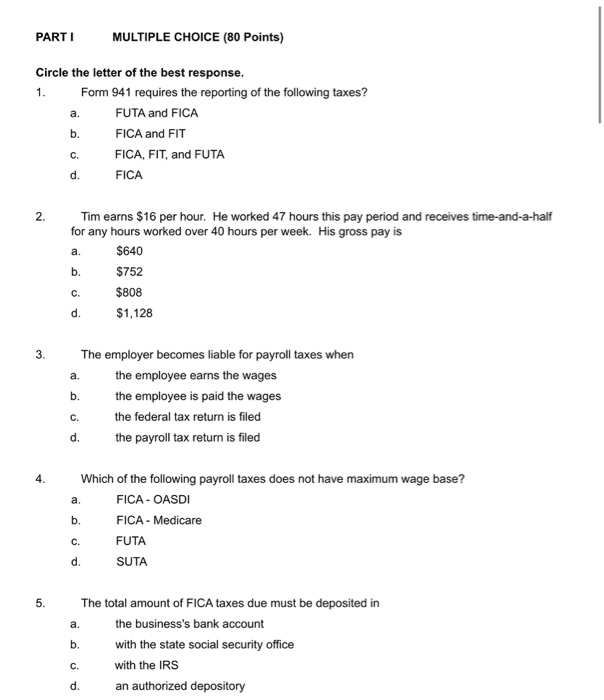

Question: Test PARTI MULTIPLE CHOICE (80 Points) a. Circle the letter of the best response. 1. Form 941 requires the reporting of the following taxes? FUTA

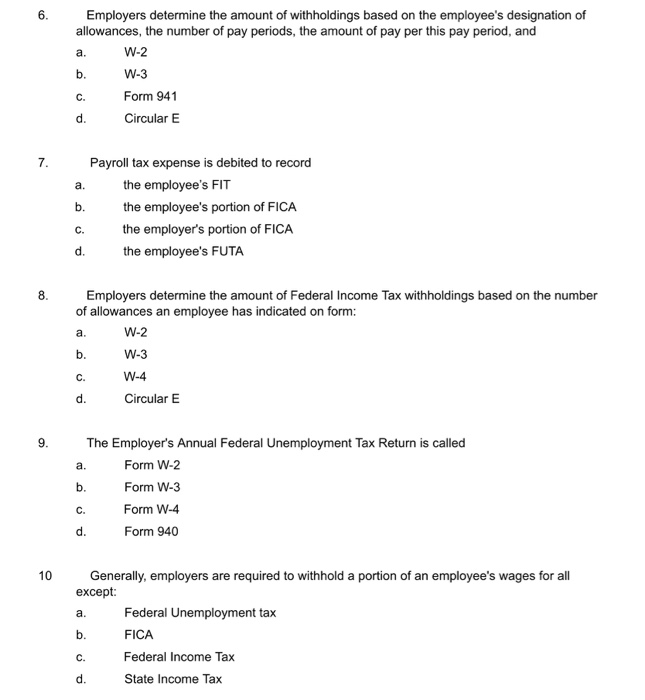

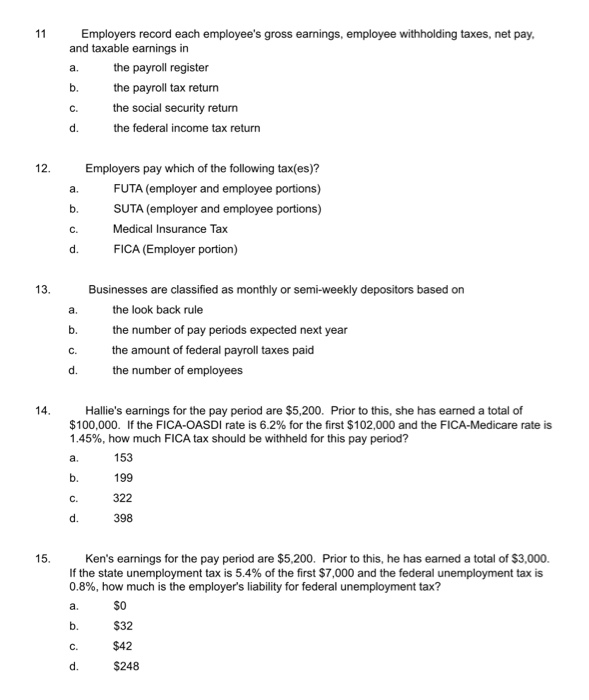

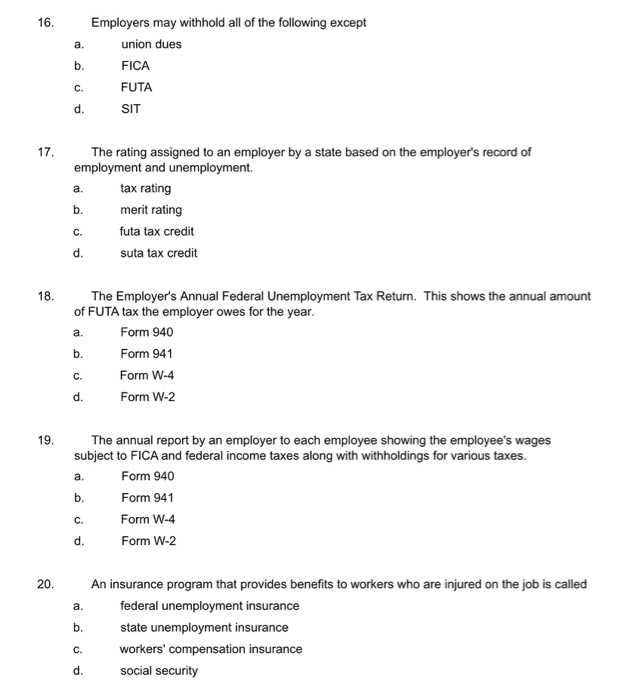

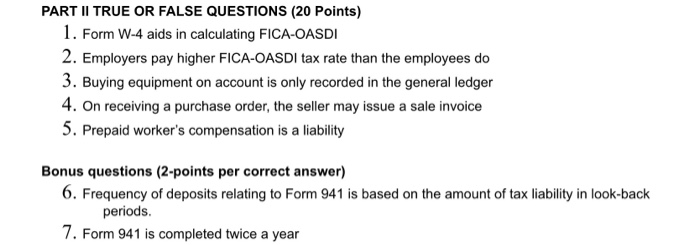

PARTI MULTIPLE CHOICE (80 Points) a. Circle the letter of the best response. 1. Form 941 requires the reporting of the following taxes? FUTA and FICA FICA and FIT FICA, FIT, and FUTA FICA b C. d. 2. a. Tim earns $16 per hour. He worked 47 hours this pay period and receives time-and-a-half for any hours worked over 40 hours per week. His gross pay is $640 $752 $808 $1,128 b. c. d. 3. a. b. The employer becomes liable for payroll taxes when the employee earns the wages the employee is paid the wages the federal tax return is filed the payroll tax return is filed C. d. 4. a. b. Which of the following payroll taxes does not have maximum wage base? FICA - OASDI FICA - Medicare FUTA SUTA C. d. 5. a. b. The total amount of FICA taxes due must be deposited in the business's bank account with the state social security office with the IRS an authorized depository c. d. 6. a. Employers determine the amount of withholdings based on the employee's designation of allowances, the number of pay periods, the amount of pay per this pay period, and W-2 W-3 Form 941 Circular E b. c. d. 7. a. Payroll tax expense is debited to record the employee's FIT b. the employee's portion of FICA the employer's portion of FICA the employee's FUTA c. d. 8. a Employers determine the amount of Federal Income Tax withholdings based on the number of allowances an employee has indicated on form: W-2 b. W-3 W-4 Circular E C. d. 9. a. b. The Employer's Annual Federal Unemployment Tax Return is called Form W-2 Form W-3 Form W-4 Form 940 C. d. 10 a. Generally, employers are required to withhold a portion of an employee's wages for all except: Federal Unemployment tax b. FICA Federal Income Tax d. State Income Tax C. 11 Employers record each employee's gross earnings, employee withholding taxes, net pay. and taxable earnings in a. the payroll register the payroll tax return the social security return d. the federal income tax return b. C. 12 a b. Employers pay which of the following tax(es)? FUTA (employer and employee portions) SUTA (employer and employee portions) Medical Insurance Tax FICA (Employer portion) C. d. 13. a. b. Businesses are classified as monthly or semi-weekly depositors based on the look back rule the number of pay periods expected next year the amount of federal payroll taxes paid the number of employees c. d. 14. a. Hallie's earnings for the pay period are $5,200. Prior to this, she has earned a total of $100,000. If the FICA-OASDI rate is 6.2% for the first $102,000 and the FICA-Medicare rate is 1.45%, how much FICA tax should be withheld for this pay period? 153 199 322 398 b. C. d. 15. a. Ken's earnings for the pay period are $5,200. Prior to this, he has earned a total of $3,000. If the state unemployment tax is 5.4% of the first $7,000 and the federal unemployment tax is 0.8%, how much is the employer's liability for federal unemployment tax? $0 $32 $42 d. $248 b. C 16. a. Employers may withhold all of the following except union dues b. FICA FUTA d. SIT c. 17. a. The rating assigned to an employer by a state based on the employer's record of employment and unemployment. tax rating merit rating futa tax credit suta tax credit b. c. d. 18. a. The Employer's Annual Federal Unemployment Tax Return. This shows the annual amount of FUTA tax the employer owes for the year. Form 940 Form 941 Form W-4 Form W-2 b. C. d. 19. a. The annual report by an employer to each employee showing the employee's wages subject to FICA and federal income taxes along with withholdings for various taxes. Form 940 Form 941 Form W-4 Form W-2 b. c. d. 20. a. b. An insurance program that provides benefits to workers who are injured on the job is called federal unemployment insurance state unemployment insurance workers' compensation insurance social security C. d. PART II TRUE OR FALSE QUESTIONS (20 Points) 1. Form W-4 aids in calculating FICA-OASDI 2. Employers pay higher FICA-OASDI tax rate than the employees do 3. Buying equipment on account is only recorded in the general ledger 4. On receiving a purchase order, the seller may issue a sale invoice 5. Prepaid worker's compensation is a liability Bonus questions (2-points per correct answer) 6. Frequency of deposits relating to Form 941 is based on the amount of tax liability in look back periods. 7. Form 941 is completed twice a year

Step by Step Solution

There are 3 Steps involved in it

Sure lets go through the questions Multiple Choice 1 D FICA Form 941 requires the reporting of FICA and FIT Federal Income Tax 2 C 808 Tim works 47 ho... View full answer

Get step-by-step solutions from verified subject matter experts