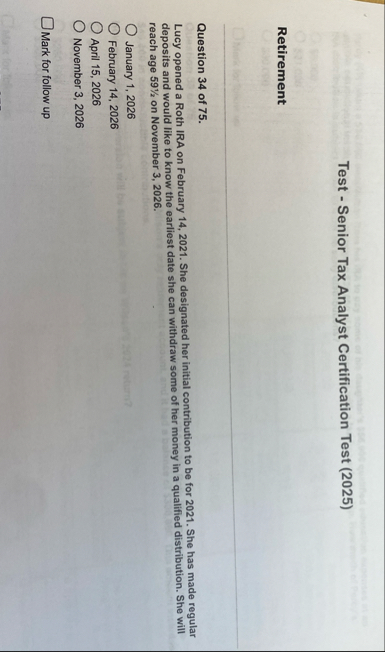

Question: Test - Senior Tax Analyst Certification Test ( 2 0 2 5 ) Retirement Question 3 4 of 7 5 . Lucy opened a Roth

Test Senior Tax Analyst Certification Test

Retirement

Question of

Lucy opened a Roth IRA on February She designated her initial contribution to be for She has made regular deposits and would like to know the earliest date she can withdraw some of her money in a qualified distribution. She will reach age on November

January

February

April

November

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock