Question: Test - Senior Tax Specialist Certification Test ( 2 0 2 4 ) Employee Stock Options Question 6 0 of 7 5 . How is

Test Senior Tax Specialist Certification Test

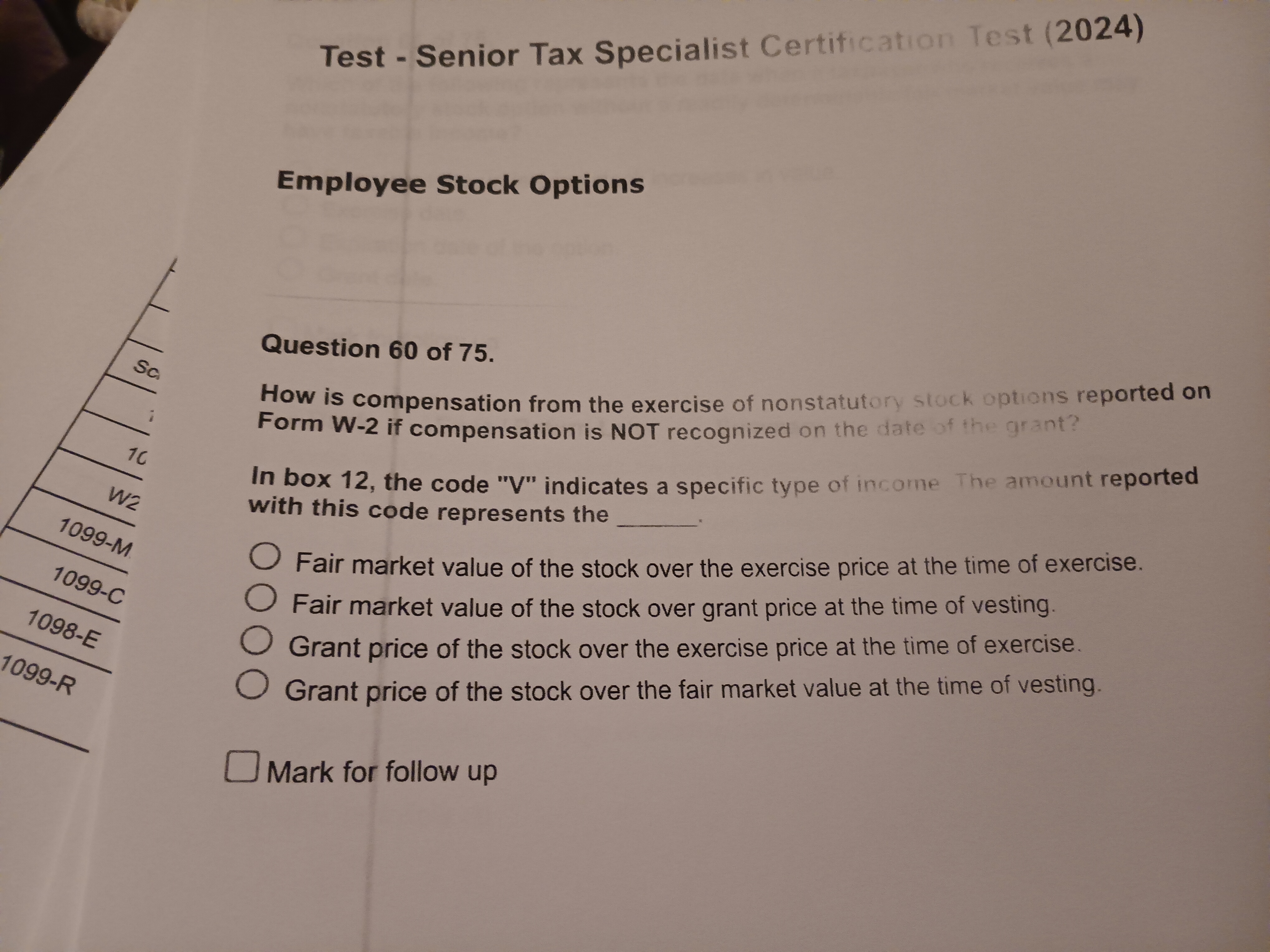

Employee Stock Options

Question of

How is compensation from the exercise of nonstatuton stock options reported on Form W if compensation is NOT recognized on the date of the grant?

In box the code V indicates a specific type of income The amount reported with this code represents theFair market value of the stock over the exercise price at the time of exercise.Fair market value of the stock over grant price at the time of vesting.Grant price of the stock over the exercise price at the time of exercise.Grant price of the stock over the fair market value at the time of vesting.Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock