Question: Test - Tax Update Supplemental ( 2 0 Module 3 Question 3 of 6 . Jules was hired by the Lawn Doctors and his first

Test Tax Update Supplemental

Module

Question of

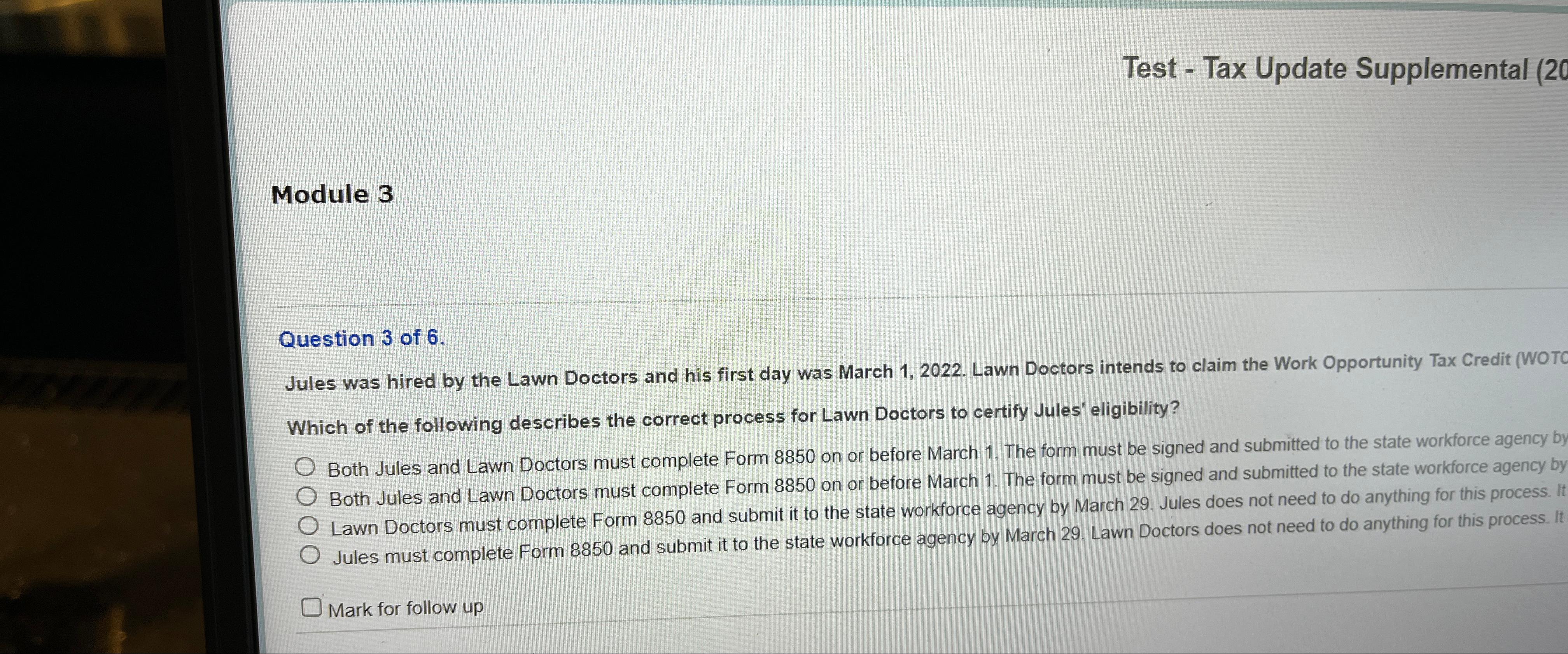

Jules was hired by the Lawn Doctors and his first day was March Lawn Doctors intends to claim the Work Opportunity Tax Credit WOTC

Which of the following describes the correct process for Lawn Doctors to certify Jules' eligibility?

Both Jules and Lawn Doctors must complete Form on or before March The form must be signed and submitted to the state workforce agency by

Both Jules and Lawn Doctors must complete Form on or before March The form must be signed and submitted to the state workforce agency by

Lawn Doctors must complete Form and submit it to the state workforce agency by March Jules does not need to do anything for this process. It

Jules must complete Form and submit it to the state workforce agency by March Lawn Doctors does not need to do anything for this process. It

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock