Question: Testbank, Question 94 A company must choose between two mutually exclusive projects: Alpha and Bravo, to enhance its current operations. Project Alpha requires a $12,000

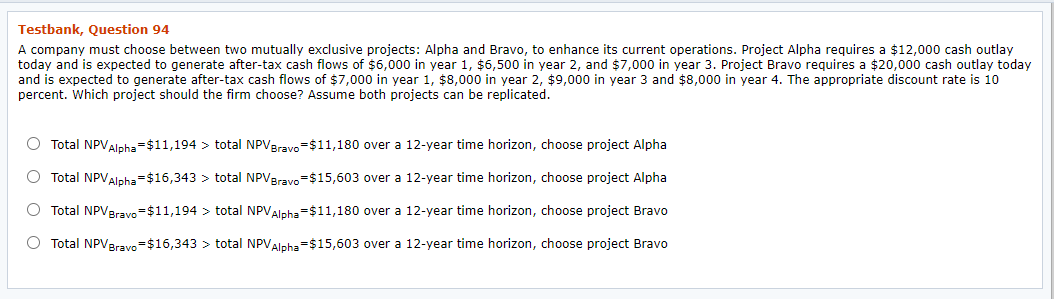

Testbank, Question 94 A company must choose between two mutually exclusive projects: Alpha and Bravo, to enhance its current operations. Project Alpha requires a $12,000 cash outlay today and is expected to generate after-tax cash flows of $6,000 in year 1, $6,500 in year 2, and $7,000 in year 3. Project Bravo requires a $20,000 cash outlay today and is expected to generate after-tax cash flows of $7,000 in year 1, $8,000 in year 2, $9,000 in year 3 and $8,000 in year 4. The appropriate discount rate is 10 percent. Which project should the firm choose? Assume both projects can be replicated. O Total NPV Alpha=$11,194 > total NPV Bravo =$11,180 over a 12-year time horizon, choose project Alpha O Total NPV Alpha= $16,343 > total NPVBravo = $15,603 over a 12-year time horizon, choose project Alpha O Total NPV Bravo=$11,194 > total NPV Alpha=$11,180 over a 12-year time horizon, choose project Bravo O Total NPV Bravo = $16,343 > total NPV Alpha=$15,603 over a 12-year time horizon, choose project Bravo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts