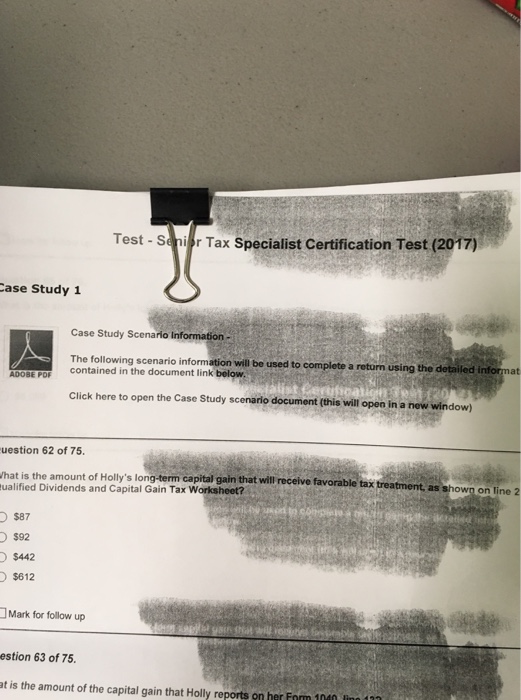

Question: Test-Senir Tax Specialist Certification Test (2017) ase Study 1 Case Study Scenario Information - The following scenario information will be used to complete a retum

Test-Senir Tax Specialist Certification Test (2017) ase Study 1 Case Study Scenario Information - The following scenario information will be used to complete a retum using the detailed informat Click here to open the Case Study scenario document (this will open in a new window ADOBE POF uestion 62 of 75 hat is the amount of Holly's long-term capital gain that will receive favorable tax ualified Dividends and Capital Gain Tax Worksheet? t, as shown on line 2 $87 $92 $442 $612 Mark for follow up estion 63 of 75. at is the amount of the capital gain that Holly reports on her Form 1040 lin1 Test-Senir Tax Specialist Certification Test (2017) ase Study 1 Case Study Scenario Information - The following scenario information will be used to complete a retum using the detailed informat Click here to open the Case Study scenario document (this will open in a new window ADOBE POF uestion 62 of 75 hat is the amount of Holly's long-term capital gain that will receive favorable tax ualified Dividends and Capital Gain Tax Worksheet? t, as shown on line 2 $87 $92 $442 $612 Mark for follow up estion 63 of 75. at is the amount of the capital gain that Holly reports on her Form 1040 lin1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts