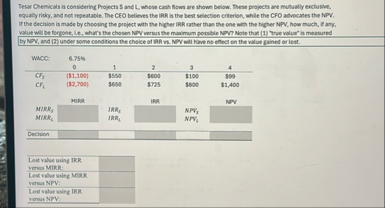

Question: Tesur Chemicals is considering Projects $ and L , whese canh flows are shown below, These projects are multually exclusive. equally righy, and not repeatable.

Tesur Chemicals is considering Projects $ and L whese canh flows are shown below, These projects are multually exclusive. equally righy, and not repeatable. The CEO believes the IRR is the best selection erterion, while the CFO advocates the NPV If the decinion is made by cheosing the project with the higher IRR ather than the one with the higher NPV how much, any. volue will be forgone, Le whars the chasen NPV werus the madmum pousible NPVP Note that "Yroe value" is masured by NPN and under some conditions the chaice of IRR vi NPV sall flove no effect on the value gained or lost.

tableWHCC:$$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock