Question: Teuc/False (5 points each)-Answer on bubble sheet ullnner Semester, 2018 ion is born by application to the federal government. 1. A corporat : A partnership

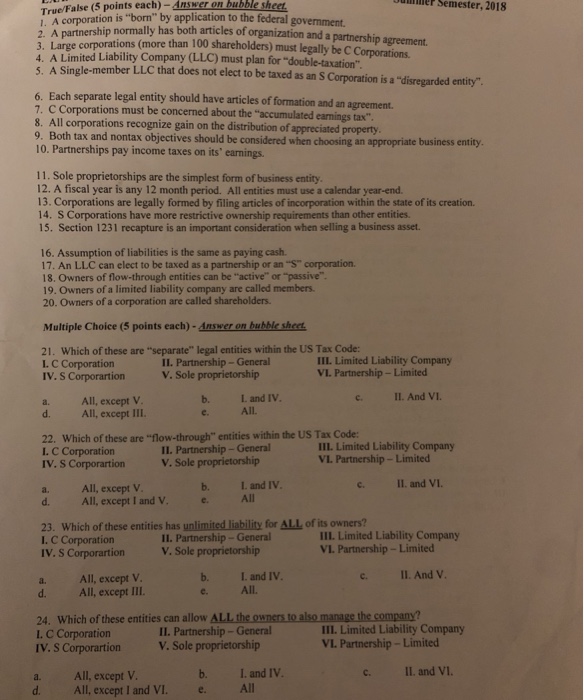

Teuc/False (5 points each)-Answer on bubble sheet ullnner Semester, 2018 ion is "born" by application to the federal government. 1. A corporat : A partnership normally hasboth articles of organization and a partnership agreement. 3. Large corporations (more than 100 shareholders) must legally be CC A Limited Liability Company (LLC) must plan for "double-taxation" 5. A Single-member LLC that does not elect to be taxed as an S Corporation is a "disregarded entity. 6. Each separate legal entity should have articles of formation and an agreement 7. C Corporations must be concerned about the "accumulated earnings tax" 8. All corporations recognize gain on the distribution of appreciated property 9. Both tax and nontax objectives should be considered when choosing an appropriate 10. Partnerships pay income taxes on its' earnings business entity 11. Sole proprietorships are the simplest form of business entity 12. A fiscal year is any 12 month period. All entities must use a calendar year-end 13. Corporations are legally formed by filing articles of incorporation within the state of its creation. 14. S Corporations have more restrictive ownership requirements than other entities 15. Section 1231 recapture is an important consideration when selling a business asset. 16. Assumption of liabilities is the same as paying cash. 17. An LLC can elect to be taxed as a partnership or an "S" corporation. 18. Owners of flow-through entities can be "active" or "passive 19. Owners of a limited liability company are called members 20. Owners of a corporation are called shareholders. Multiple Choice (5 points each)- Answer on bubble sheet 21. Which of these are "separate" legal entities within the US Tax Code: IV. S CorporartionV. Sole proprietorship IIL. Limited Liability Company VI. Partnership - Limited I1. Partnership - General All, except V All, except II b. e. L and IV. All. c. 11. And VI d. 22. Which of these are "flow-through" entities within the US Tax Code: I. C Corporation IV, S Corporation V. Sole proprietorship III. Limited Liability Company VI. Partnership-Limited II. Partnership -General All, except V b. b. L and IV Il. and V. d. All, except I and V 23. Which of these entities has unlimited liability for ALL of its owners? I. C Corporation IV. S Corporartion V.Sole proprietorship IIL. Limited Liability Company VI. Partnership-Limited II. Partnership- General Il. And V. a. All, except V d. All, except III b. I and IV e. c. All. 24. Which of these entities can allow ALL the owners to also manage the company? L. C Corporation IV. S Corporartion V. Sole proprietorship III. Limited Liability Company VL. Partnership-Limited II. Partnership General I. and IV c. IL. and VI. a. All, except V d. All, except I and VI eAll

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts