Question: . TEW 4:05 PM Chapter 8 Activity 3.docx Accounting 2102 Chapter 8: Receivables Activity 3 Company XYZ has credit sales of $5,000,000. They estimate that

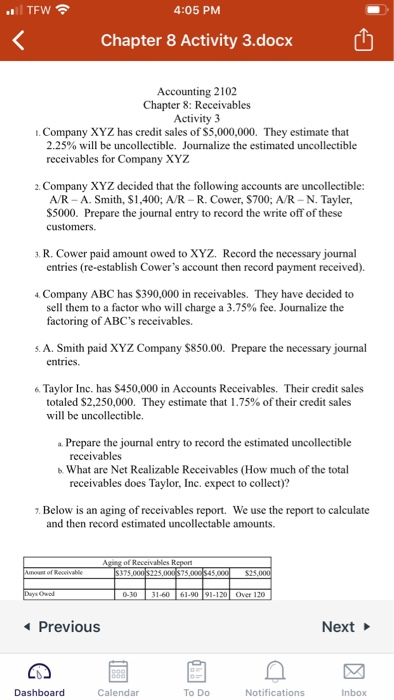

. TEW 4:05 PM Chapter 8 Activity 3.docx Accounting 2102 Chapter 8: Receivables Activity 3 Company XYZ has credit sales of $5,000,000. They estimate that 2.25% will be uncollectible. Journalize the estimated uncollectible receivables for Company XYZ 2. Company XYZ decided that the following accounts are uncollectible: A/R - A. Smith, $1,400; A/R - R. Cower, S700; A/R - N. Tayler, $5000. Prepare the journal entry to record the write off of these customers. 3. R. Cower paid amount owed to XYZ. Record the necessary journal entries (re-establish Cower's account then record payment received). 4. Company ABC has $390,000 in receivables. They have decided to sell them to a factor who will charge a 3.75% fee. Journalize the factoring of ABC's receivables. 5. A. Smith paid XYZ Company $850.00. Prepare the necessary journal entries. 6. Taylor Inc. has $450,000 in Accounts Receivables. Their credit sales totaled $2,250,000. They estimate that 1.75% of their credit sales will be uncollectible. .. Prepare the journal entry to record the estimated uncollectible receivables What are Net Realizable Receivables (How much of the total receivables does Taylor, Inc. expect to collect)? 7. Below is an aging of receivables report. We use the report to calculate and then record estimated uncollectable amounts. Aging of Receivables Report $375.000 $225,000 $75,000 SAS.CO Amount of Receivable 525.000 Days 0-30 31-60 61-90 91-120 Over 120

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts