Question: Texas Instruments is considering a project that has an up-front cost at t = 0 of $1, 200,000. The project's subsequent cash flows critically depend

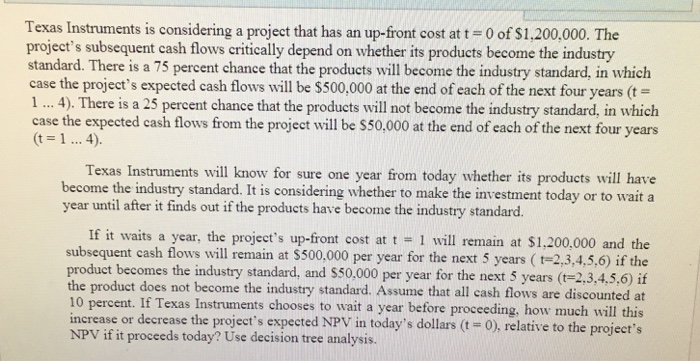

Texas Instruments is considering a project that has an up-front cost at t = 0 of $1, 200,000. The project's subsequent cash flows critically depend on whether its products become the industry standard. There is a 75 percent chance that the products will become the industry standard, in which case the project's expected cash flows will be $500,000 at the end of each of the next four years (t = 1 ... 4). There is a 25 percent chance that the products will not become the industry standard, in which case the expected cash flows from the project will be $50,000 at the end of each of the next four years (t = 1 ... 4). Texas Instruments will know for sure one year from today whether its products will have become the industry standard. It is considering whether to make the investment today or to wait a year until after it finds out if the products have become the industry standard. If it waits a year, the project's up-front cost at t = 1 will remain at $1, 200,000 and the subsequent cash flows will remain at $500,000 per year for the next 5 years (t = 2, 3, 4, 5, 6) if the product becomes the industry standard, and $50,000 per year for the next 5 years (t = 2, 3, 4, 5, 6) if the product does not become the industry standard. Assume that all cash flows are discounted at 10 percent. If Texas Instruments chooses to wait a year before proceeding, how much will tins increase or decrease the project's expected NPV in today s dollars (t = 0), relative to the project's NPV if it proceeds today? Use decision tree analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts