Question: Text Roboto 10.5 BIU A ilul E DE 1 1 2 1 13 + 4 5 LO 9-1, 9-2 2. Business k exchanged an old

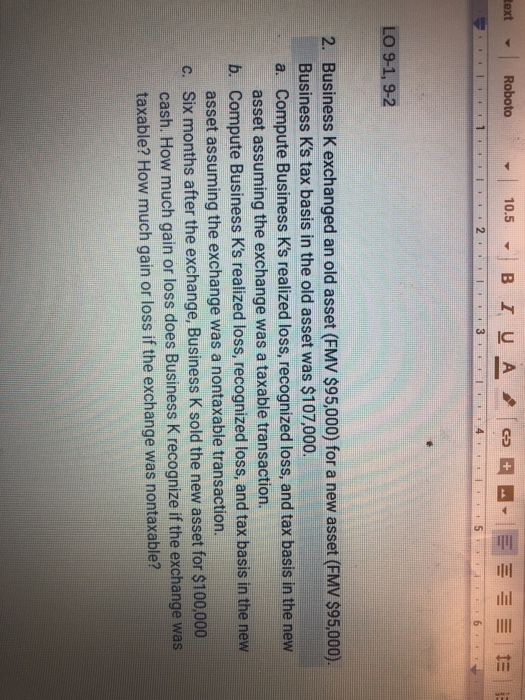

Text Roboto 10.5 BIU A ilul E DE 1 1 2 1 13 + 4 5 LO 9-1, 9-2 2. Business k exchanged an old asset (FMV $95,000) for a new asset (FMV $95,000). Business K's tax basis in the old asset was $107,000. a. Compute Business K's realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a taxable transaction. b. Compute Business K's realized loss, recognized loss, and tax basis in the new asset assuming the exchange was a nontaxable transaction. c. Six months after the exchange, Business K sold the new asset for $100,000 cash. How much gain or loss does Business K recognize if the exchange was taxable? How much gain or loss if the exchange was nontaxable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts