Question: Text : We will perform the following analysis under the Modigliani-Miller assumptions of no tax advantages of debt and no bankruptcy costs and use a

Text:

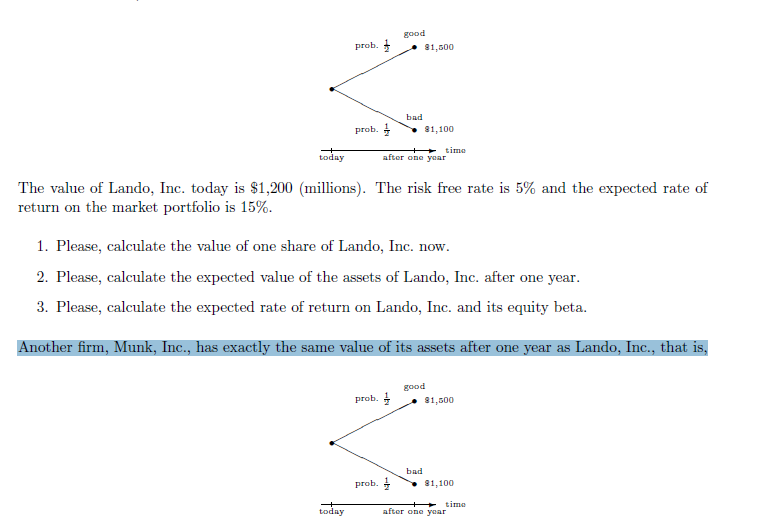

We will perform the following analysis under the Modigliani-Miller assumptions of no tax advantages of debt and no bankruptcy costs and use a simple one period binomial tree to model the uncertainty of the assets of the firm. First we analyze a 100% equity Financed firm, Lando, Inc., who have 10 million shares outstanding. The following simple binomial tree models the uncertainty of the assets of the rm: (all numbers are in millions of dollars)

The value of Lando, Inc. today is $1,200 (millions). The risk free rate is 5% and the expected rate of return on the market portfolio is 15%.

Another rm, Munk, Inc., has exactly the same value of its assets after one year as Lando, Inc., that is,

Munk, Inc. has just issued debt earlier today with one year maturity and a coupon equal to the risk free rate. The face value of the debt is $1,000 (millions). The rest of Munk, Inc.'s capital structure consist of equity. The debt was priced fairly at the issue time and the conditions on the issue time and now are identical.

Question: What is the beta of the debt of Munk, Inc.?

The book used in this course is Corporate finance by Berk and Demarzo, 4 edition.

good prob. 1,500 / bad prob. 1 91,100 ti today after ono year The value of Land, Inc. today is $1,200 (millions). The risk free rate is 5% and the expected rate of return on the market portfolio is 15%. 1. Please, calculate the value of one share of Lando, Inc. now. 2. Please, calculate the expected value of the assets of Lando, Inc. after one year. 3.Please,caleulate the espected rate of return on Lando, Inc. and its equity beta. Another firm, Munk, Inc., has exactly the same value of its assets after one year as Lando, Inc., that is, prob. 81,500 bad prob. 781,100 Rin after one yoar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts