Question: TF . 0 5 - 0 0 3 Since a contribution to an IRA is a voluntary action, a taxpayer may withdraw amounts from an

TF

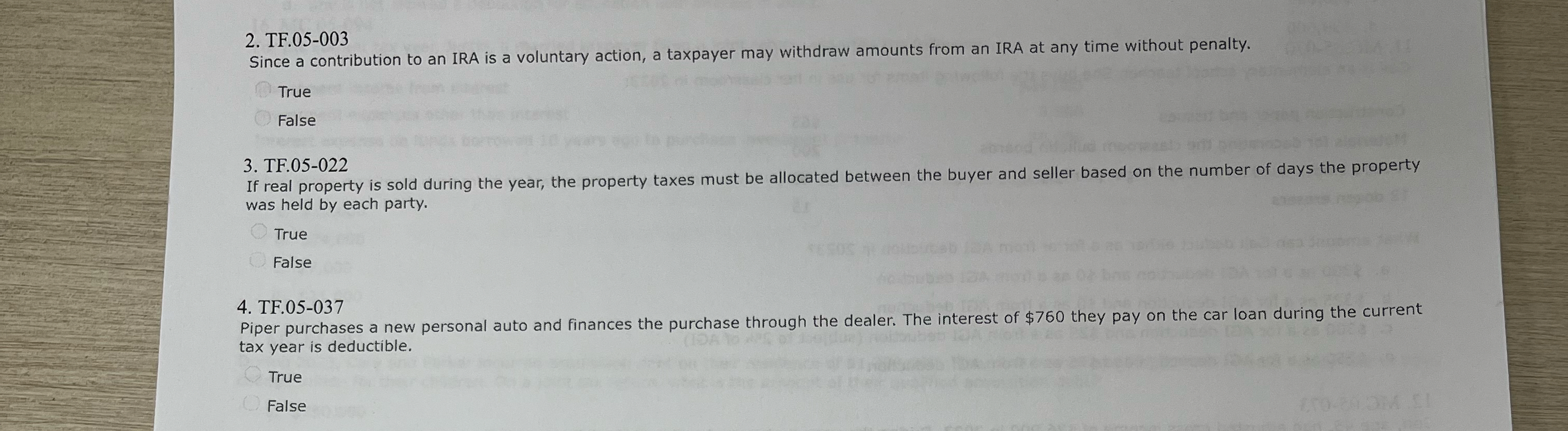

Since a contribution to an IRA is a voluntary action, a taxpayer may withdraw amounts from an IRA at any time without penalty.

True

False

TF

If real property is sold during the year, the property taxes must be allocated between the buyer and seller based on the number of days the property was held by each party.

True

False

TF

Piper purchases a new personal auto and finances the purchase through the dealer. The interest of $ they pay on the car loan during the current tax year is deductible.

True

False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock