Question: T/F 17. In general, a practitioner must, at the request of a client, promptly return any and all records of the client that are necessary

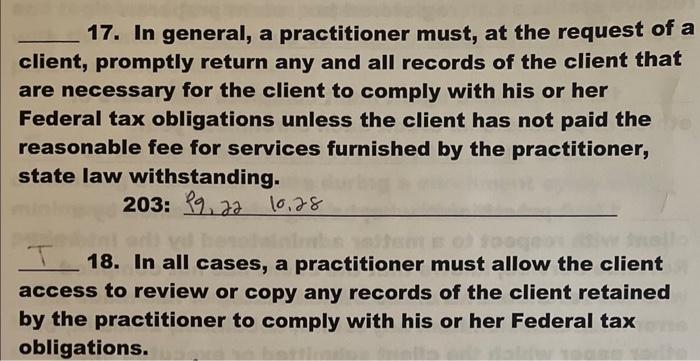

17. In general, a practitioner must, at the request of a client, promptly return any and all records of the client that are necessary for the client to comply with his or her Federal tax obligations unless the client has not paid the reasonable fee for services furnished by the practitioner, state law withstanding. 203:99,2210.28 T 18. In all cases, a practitioner must allow the client access to review or copy any records of the client retained by the practitioner to comply with his or her Federal tax obligations

Step by Step Solution

There are 3 Steps involved in it

False A practitioner generally must return client records necessar... View full answer

Get step-by-step solutions from verified subject matter experts