Question: than sone one with a higher incor the progressice tox income from her job was $ 6 0 , 0 0 0 and she earned

than sone one with a higher incor the progressice tox income from her job was $ and she earned $ interest incom club raffle. During the year, she sold $ in qualified dividends on stock. She won $ from a local Rously for $ During the year, she Rottenapple stock for $ that she had purch

contributed $ to her regular IRA account.

a Compute the amount of her adjusted gross income for points

b What is her taxable income for pts

What is her tax liability for pts

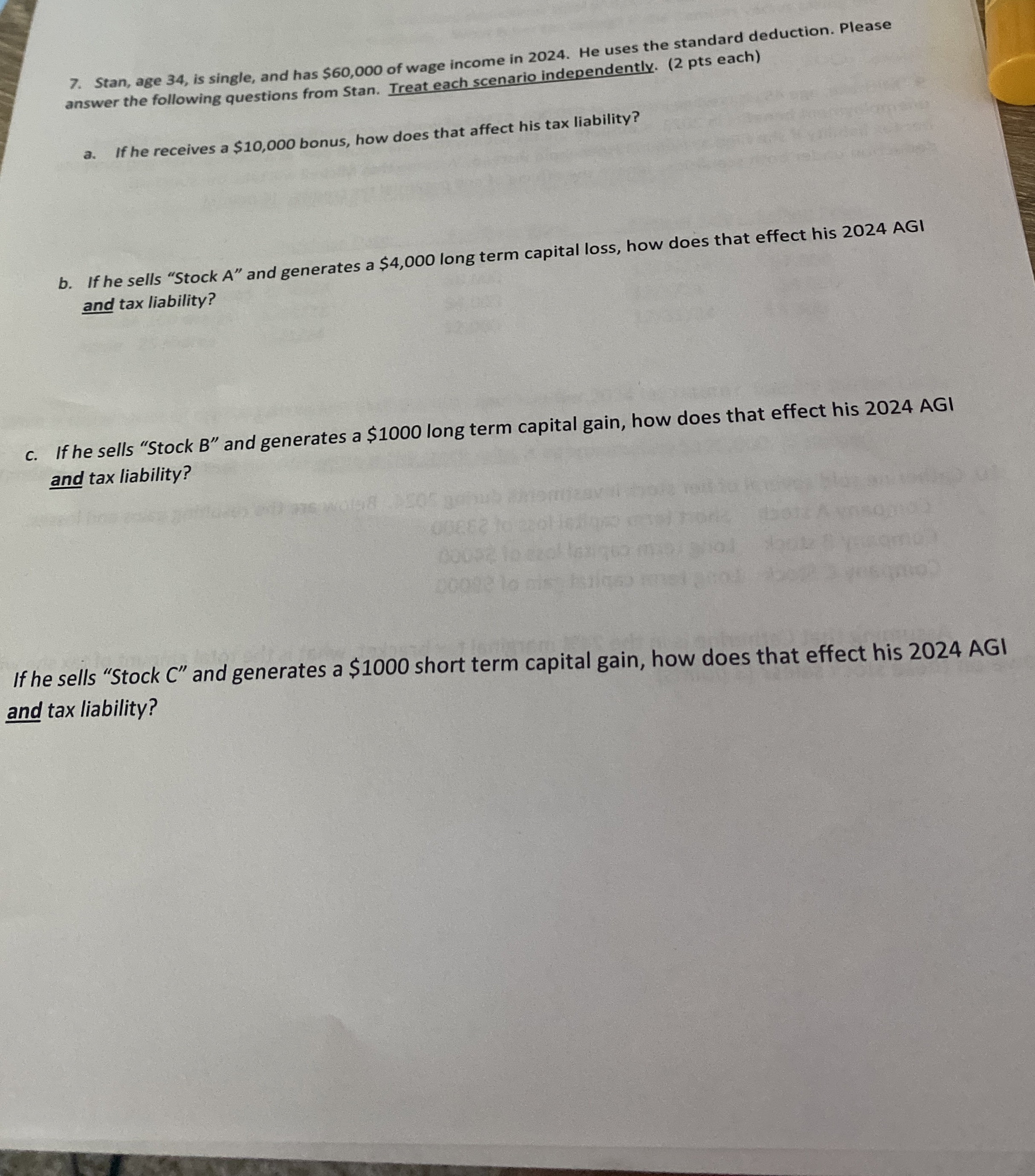

Stan, age is single, and has $ of wage income in He uses the standard deduction. Please

answer the following questions from Stan. Treat each scenario independently. pts each

a If he receives a $ bonus, how does that affect his tax liability?

b If he sells "Stock and generates a $ long term capital loss, how does that effect his AGI

and tax liability?

c If he sells "Stock B and generates a $ long term capital gain, how does that effect his AGI

and tax liability?

If he sells "Stock C and generates a $ short term capital gain, how does that effect his AGI

and tax liability?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock