Question: than zero True B False 25-27 Your U.S. bank issues a one-year U.S. CD at 5 percent annual interest to finance a C$1,250,000 (Canadian dollar)

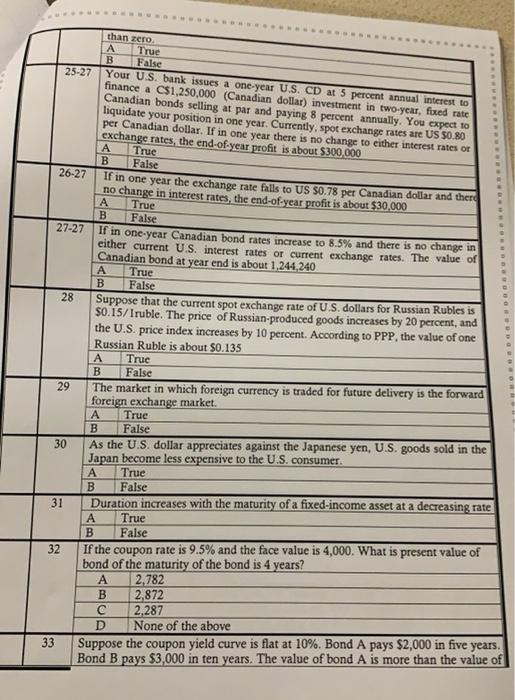

than zero True B False 25-27 Your U.S. bank issues a one-year U.S. CD at 5 percent annual interest to finance a C$1,250,000 (Canadian dollar) investment in two-year, foxed rate Canadian bonds selling at par and paying 8 percent annually. You expect to liquidate your position in one year. Currently, spot exchange rates are US $0.80 per Canadian dollar. If in one year there is no change to either interest rates or exchange rates, the end-of-year profit is about $300,000 A True B False 26-27 If in one year the exchange rate fails to US $0.78 per Canadian dollar and there no change in interest rates, the end-of-year profit is about $30,000 A True B False 27-27 If in one-year Canadian bond rates increase to 8.5% and there is no change in either current U.S. interest rates or current exchange rates. The value of Canadian bond at year end is about 1,244,240 True B False 28 Suppose that the current spot exchange rate of U.S. dollars for Russian Rubles is S0.15/Iruble. The price of Russian-produced goods increases by 20 percent, and the U.S. price index increases by 10 percent. According to PPP, the value of one Russian Ruble is about 50.135 True B False The market in which foreign currency is traded for future delivery is the forward foreign exchange market. A True B False 30 As the U.S. dollar appreciates against the Japanese yen, U.S. goods sold in the Japan become less expensive to the U.S. consumer. A True B False 31 Duration increases with the maturity of a fixed-income asset at a decreasing rate A True B False 32 If the coupon rate is 9.5% and the face value is 4,000. What is present value of bond of the maturity of the bond is 4 years? A 2,782 B 2,872 2,287 None of the above 33 Suppose the coupon yield curve flat at 10%. Bond A pays $2,000 in five years. Bond B pays $3,000 in ten years. The value of bond A is more than the value of 29 DO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts