Question: Thanize exist Currischars TMMAK B 2 8 7 4 Test - Intermediate Rental Real Estate ( 2 0 2 5 ) Rental Expenses Question 5

Thanize exist Currischars

TMMAK B

Test Intermediate Rental Real Estate

Rental Expenses

Question of

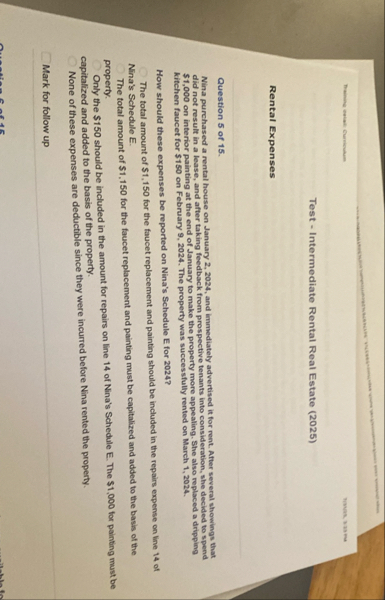

Nina purchased a rental house on January and immediately advertised it for rent. After several showings that did not result in a lease, and after taking feedback from prospective tenants into consideration, she decided to spend $ on interior painting at the end of January to make the property more appealing. She also replaced a dripping kitchen faucet for $ on February The property was successfully rented on March

How should these expenses be reported on Nina's Schedule E for

The total amount of $ for the faucet replacement and painting should be included in the repairs expense on line of Nina's Schedule E

The total amount of $ for the faucet replacement and painting must be capitalized and added to the basis of the

Only the $ should be included in the amount for repairs on line of Nina's Schedule E The $ for painting must be property. capitalized and added to the basis of the property.

None of these expenses are deductible since they were incurred before Nina rented the property.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock