Question: thank you! Caryn's current year individual return reports a $5,000 deduction for a questionable item not Requirements relating to a tax-shelter. Caryn does not make

thank you!

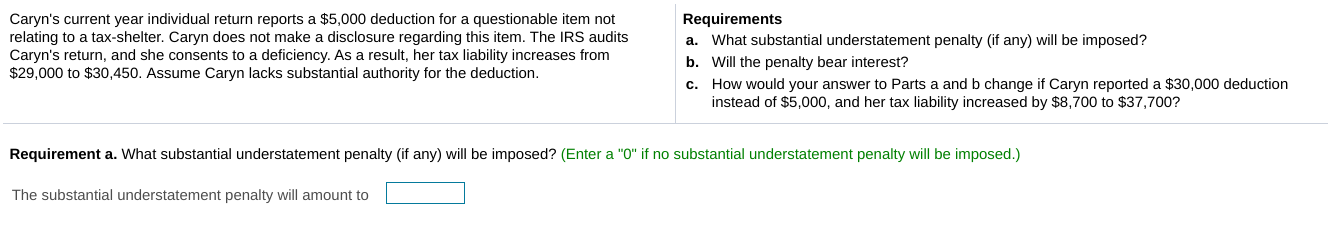

Caryn's current year individual return reports a $5,000 deduction for a questionable item not Requirements relating to a tax-shelter. Caryn does not make a disclosure regarding this item. The IRS audits a. What substantial understatement penalty (if any) will be imposed? Caryn's return, and she consents to a deficiency. As a result, her tax liability increases from b. Will the penalty bear interest? $29,000 to $30,450. Assume Caryn lacks substantial authority for the deduction. c. How would your answer to Parts a and b change if Caryn reported a $30,000 deduction instead of $5,000, and her tax liability increased by $8,700 to $37,700? Requirement a. What substantial understatement penalty (if any) will be imposed? (Enter a "0" if no substantial understatement penalty will be imposed.) The substantial understatement penalty will amount to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts