Question: thank you for help on this question Opts) The manufacturing division of an electronics company uses activity-based costing. The company as identified three activities and

thank you for help on this question

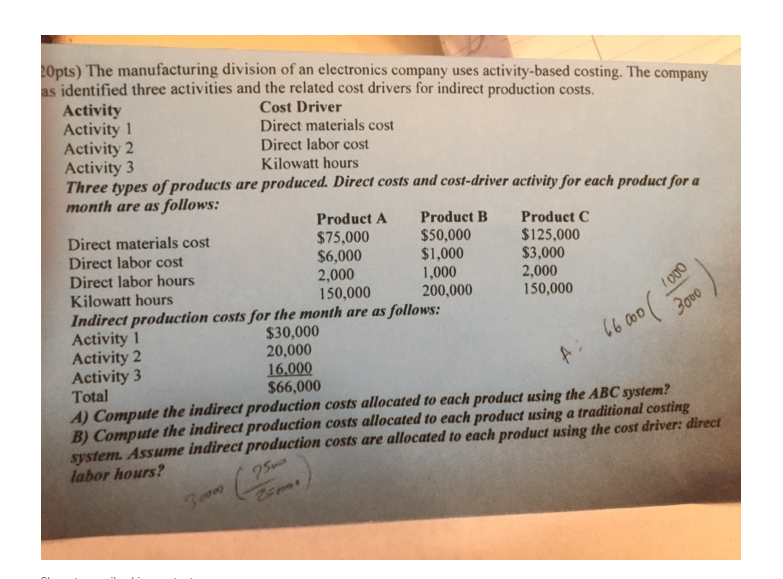

Opts) The manufacturing division of an electronics company uses activity-based costing. The company as identified three activities and the related cost drivers for indirect production costs. Activity Cost Driver Activity 1 Direct materials cost Activity 2 Direct labor cost Activity 3 Kilowatt hours Three types of products are produced. Direct costs and cost-driver activity for each product for a month are as follows: Product A Product B Product C Direct materials cost $75,000 $50,000 $125,000 Direct labor cost $6,000 $1,000 $3,000 Direct labor hours 2,000 1,000 2,000 Kilowatt hours 150,000 200,000 150,000 Indirect production costs for the month are as follows: Activity 1 $30,000 Activity 2 20,000 Activity 3 16.000 Total $66,000 A) Compute the indirect production costs allocated to each product using the ABC system? B) Compute the indirect production costs allocated to each product using a traditional costing system. Assume indirect production costs are allocated to each product using the cost driver: direct labor hours? 1000 3ovo 66000 ( (25 300w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts