Question: thank you for the help! Analyzing Impact of Inventory Errors on Reporting The records of Largo Company reveal the following. The following errors were found,

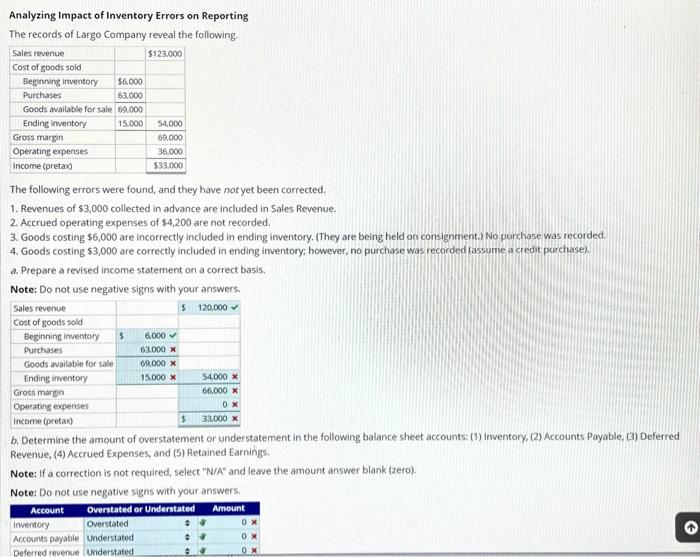

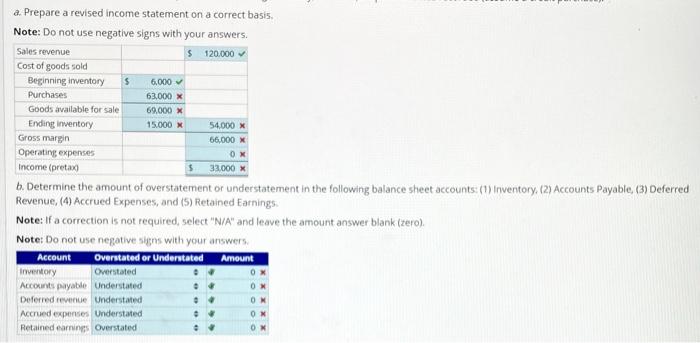

Analyzing Impact of Inventory Errors on Reporting The records of Largo Company reveal the following. The following errors were found, and they have not yet been corrected. 1. Revenues of $3,000 collected in advance are included in Sales Revenue. 2. Accrued operating expenses of $4,200 are not recorded. 3. Goods costing $6,000 are incorrectly included in ending inventory. (They are being held on consignment.) No purchase was recorded. 4. Goods costing $3,000 are correctly induded in ending inventory: however, no purchase was recorded (assume a credit purchase). a. Prepare a revised income statement on a correct basis. Note: Do not use negative signs with your answers. b. Determine the amount of overstatement or understatement in the following balance sheet accounts: (1) Inventory, (2) Accounts Payable, (3) Deferred Revenue, (4) Accrued Expenses, and (5) Retained Earnings. Note: If a correction is not required, select "N/A" and leave the amount answer blank (zero). Note: Do not use negative signs with your answers. a. Prepare a revised income statement on a correct basis, Note: Do not use negative signs with your answers. b. Determine the amount of overstatement or understatement in the following balance sheet accounts: (1) Inventory. (2) Accounts Payable, (3) Deferred Revenue, (4) Accrued Expenses, and (5) Retained Earnings. Note: If a correction is not required, select "N/A" and leave the amount answer blank (tero). Note: Do not use negative shens with your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts