Question: Thank you for your help. This is one full question of the assignment. A Financial Ratio Analysis of Target Corporation An Assessment of Its Market

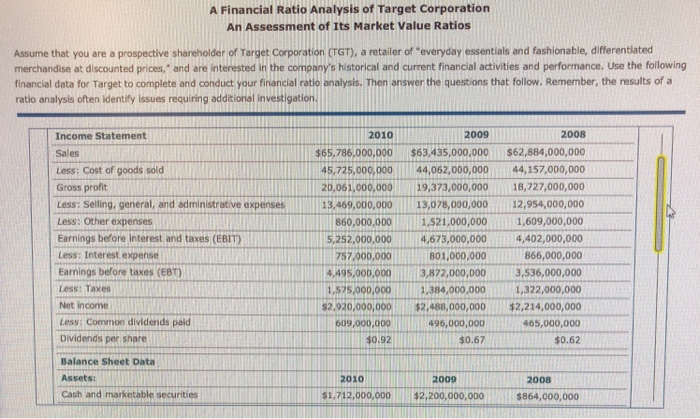

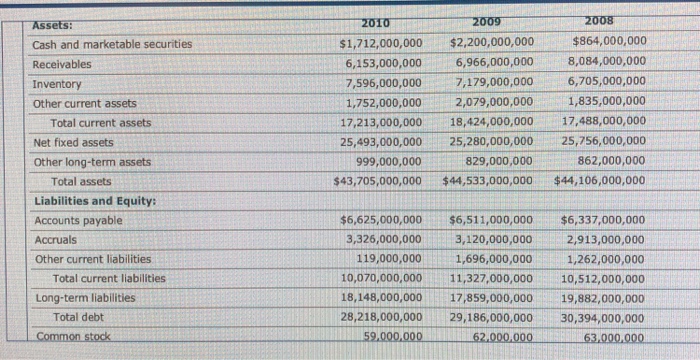

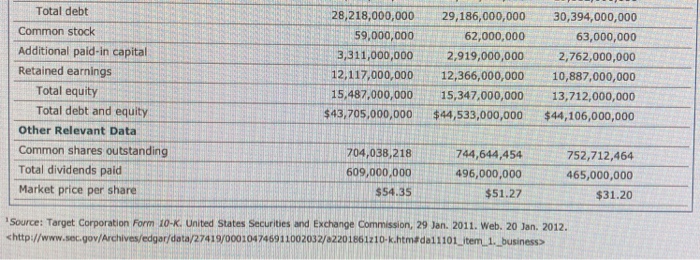

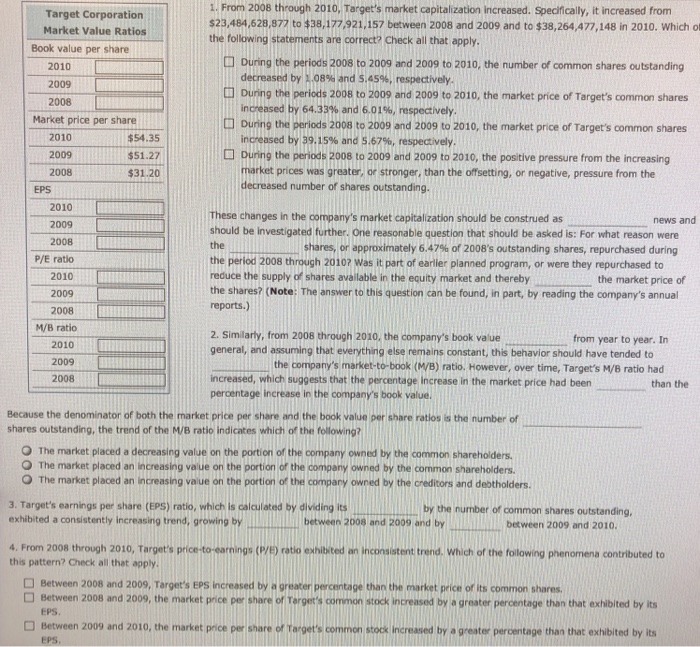

A Financial Ratio Analysis of Target Corporation An Assessment of Its Market Value Ratios Assume that you are a prospective shareholder of Target Corporation (TGT), a retailer of "everyday essentials and fashionable, differentiated merchandise at discounted prices," and are interested in the company's historical and current financial activities and performance. Use the following financial data for Target to complete and conduct your financial ratio analysis. Then answer the questions that follow. Remember, the results of a ratio analysis often identify Issues requiring additional investigation 2010 Income Statement Sales Less: Cost of goods sold Gross proft Less: Selling, general, and administrative expenses Less: Other expenses Earnings before interest and taxes (EBIT) Less: Interest expense Earnings before taxes (E8T) Less: Taxes Net income Less: Common dividends pald Dividends per share Balance Sheet Data Assets: Cash and marketable securities 2008 $65,786,000,000 $63,435,000,000 $62,884,000,000 45,725,000,000 44,062,000,00044,157,000,000 2D,061,000,00019,373,000,00018,727,000,000 13,469,000,000 13,078,000,00012,954,000,000 860,000,000 1.521,000,0001,609,000,000 5,252,000,000 4,673,000,0004,402,000,000 866,000,000 3,536,000,000 1,322,000,000 $2,920,000,000$2,488,000,000$2,214,000,000 465,000,000 $0.62 2009 57,000,000 801,000,000 4,495,000,000 3,872,000,000 1,384,000,000 1,575,000,000 609,000,000 496,000,000 $0.92 $0.67 2010 2009 2008 $1.712,00,0 2200,00,00 $864,000.000 $864,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts