Question: Thank you for your help! Your answer is incorrect. Swifty Company uses the LCNRV method, on an individual-item basis, in pricing its inventory items. The

Thank you for your help!

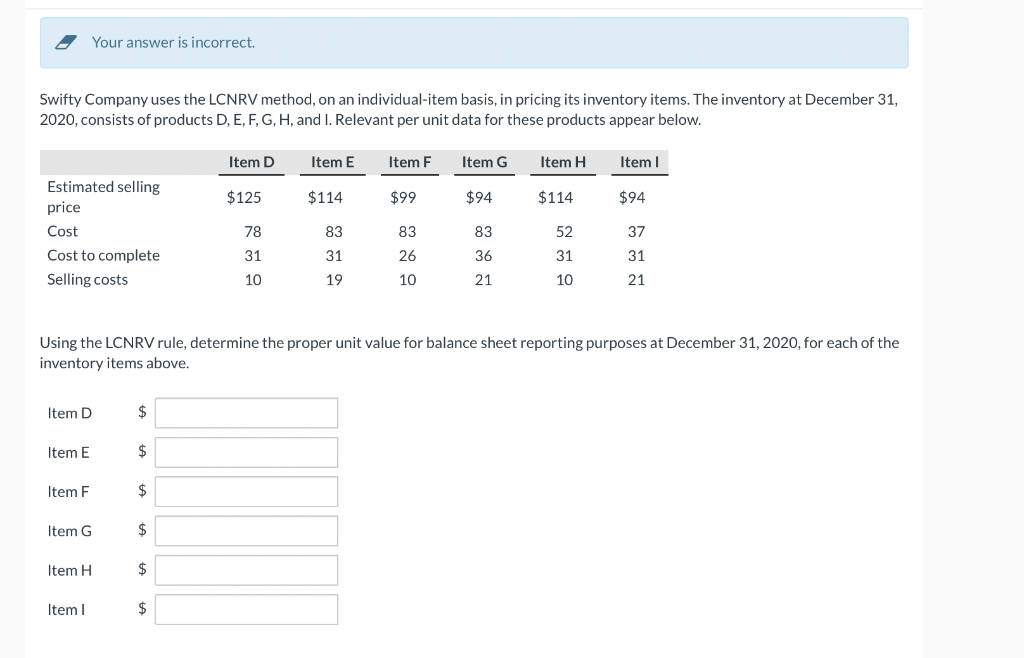

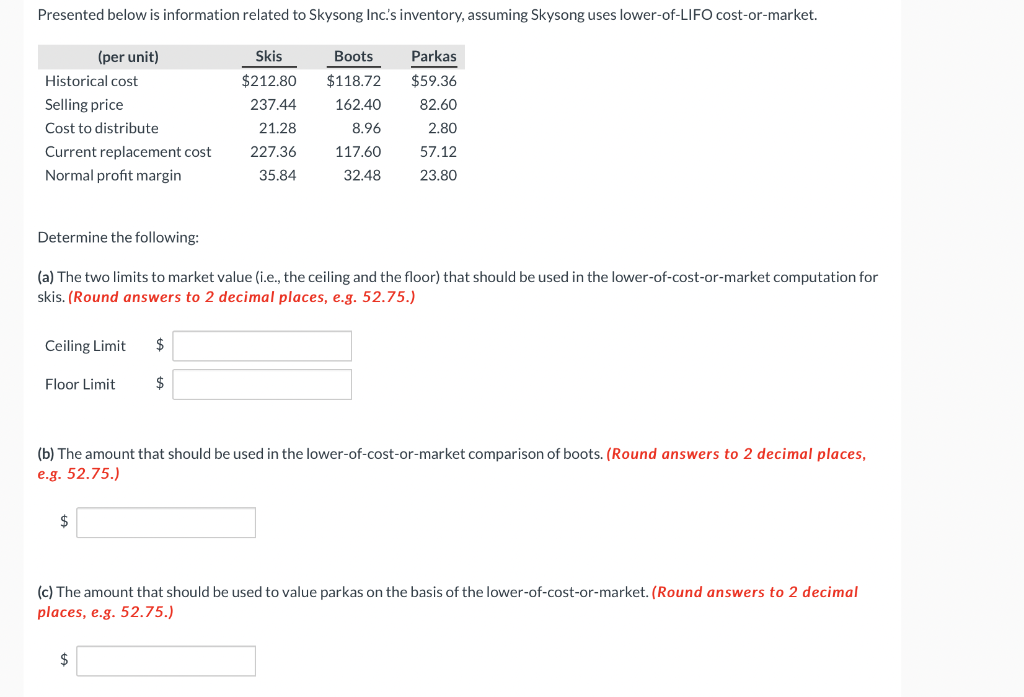

Your answer is incorrect. Swifty Company uses the LCNRV method, on an individual-item basis, in pricing its inventory items. The inventory at December 31, 2020, consists of products D, E, F, G, H, and I. Relevant per unit data for these products appear below. Item D Item E Item F Item G Item H Item $125 $114 $99 $94 $114 $94 Estimated selling price Cost Cost to complete Selling costs 78 83 83 83 31 31 36 26 10 52 31 10 37 31 21 10 19 21 Using the LCNRV rule, determine the proper unit value for balance sheet reporting purposes at December 31, 2020, for each of the inventory items above. Item D $ Item E $ Item F $ Item G $ Item H $ Item $ Presented below is information related to Skysong Inc.'s inventory, assuming Skysong uses lower-of-LIFO cost-or-market. Boots $118.72 162.40 (per unit) Historical cost Selling price Cost to distribute Current replacement cost Normal profit margin Skis $212.80 237.44 21.28 227.36 35.84 Parkas $59.36 82.60 2.80 57.12 23.80 8.96 117.60 32.48 Determine the following: (a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis. (Round answers to 2 decimal places, e.g. 52.75.) Ceiling Limit $ Floor Limit $ (b) The amount that should be used in the lower-of-cost-or-market comparison of boots. (Round answers to 2 decimal places, e.g. 52.75.) $ (c) The amount that should be used to value parkas on the basis of the lower-of-cost-or-market. (Round answers to 2 decimal places, e.g. 52.75.) $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts