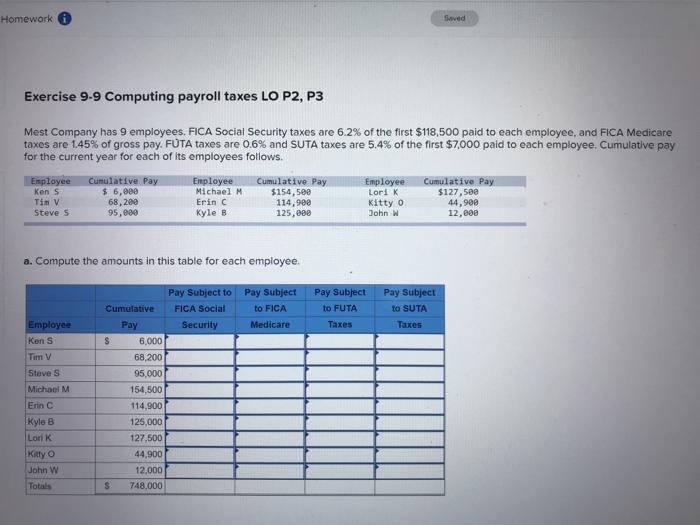

Question: thank you! Homework Sved Exercise 9-9 Computing payroll taxes LO P2, P3 Mest Company has 9 employees, FICA Social Security taxes are 6.2% of the

thank you!

thank you!Homework Sved Exercise 9-9 Computing payroll taxes LO P2, P3 Mest Company has 9 employees, FICA Social Security taxes are 6.2% of the first $118,500 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay, FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows. Employee Ken 5 Tim v Steve s Cumulative Pay $ 6,000 68,200 95,000 Employee Michael M Erin C Kyle B Cumulative Pay $154,500 114,988 125,000 Employee Lorik Kitty o John W Cumulative Pay $127,500 44,900 12,000 a. Compute the amounts in this table for each employee. Pay Subject to FICA Medicare Pay Subject to FUTA Taxes Pay Subject to SUTA Taxes Pay Employee Kons Tim v Steve S Michael M Erinc Kyle 6 Lorik Kitty John W Totals Pay Subject to Cumulative FICA Social Security $ 6.000 68,200 95,000 154,500 114.900 125,000 127.500 44,900 12,000 S 748.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts